📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

50-100%

- Net Income Growth Range (1Y):

50-100%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

0.00%

Amount: $0.000000

Yield: -

Pay Date: -

Details:

Ratio: 2:1

📅 SGX Earnings Announcements for 43A

GS Holdings Limited (43A)

Market: SGX |

Currency: SGD

Address: No. 04-73 Midview City

GS Holdings Limited, an investment holding company, engages in leasing, operating, and managing self-owned or leased food courts, coffee shops, and eating houses in Singapore and Brunei. The company also operates food courts/coffee shops under the Hao Kou Wei brand; a chicken rice restaurant and chicken rice stalls in food courts under the Sing Swee Kee brand; a food kiosk under the Sing Swee Kee Express brand; halal chicken rice stall in the food court under the Rasa Chicken brand; and a local coffee cafe under the Raffles Coffee brand. In addition, it provides branding, operation, and procurement services, such as branding management, operational support, central procurement, recruitment, and customized training and development of human resources, as well as consultancy and management services in the food and beverage industry. Further, the company engages in processing and manufacturing of food products; and developing, franchising, trading, distribution, and management of food and beverage products and brands. GS Holdings Limited was incorporated in 2014 and is based in Singapore.

Show more

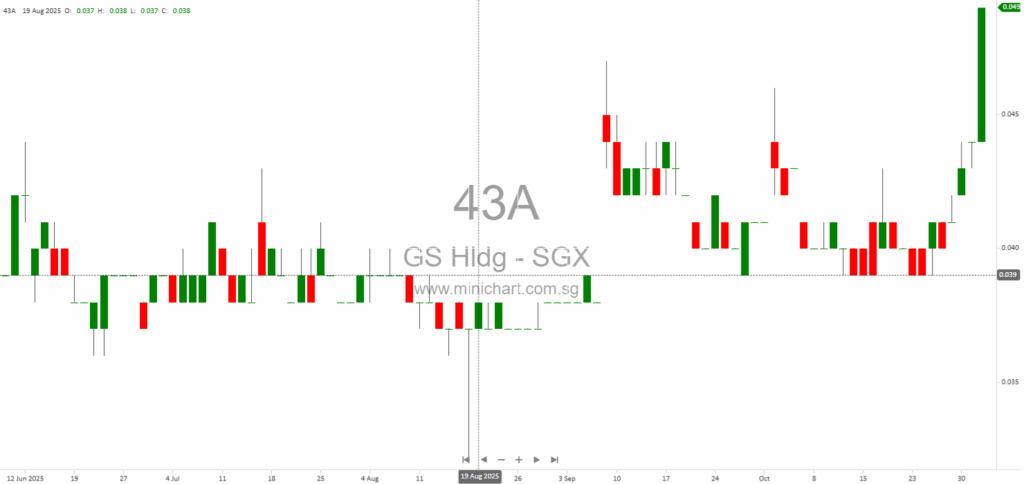

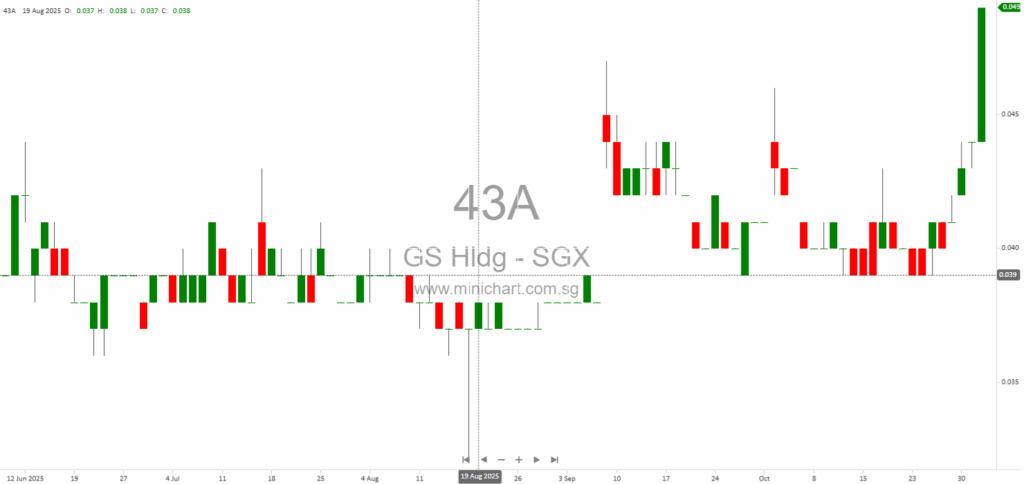

📈 GS Holdings Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 15, 2026

China Sunsine Chemical Holdings Ltd.: FY2025 Financial Announcement & Company Overview China Sunsine Chemical Holdings Ltd. has issued an announcement regarding the release of its unaudited interim financial statements for the second half and full year ended 31 December 2025.…

February 14, 2026

Casa Holdings Limited: 2026 AGM Review – Key Developments and Investor Insights Casa Holdings Limited held its Annual General Meeting (AGM) on 23 January 2026 at its Singapore headquarters. The event provided shareholders and stakeholders with valuable insights into the…

February 14, 2026

Date: 23 January 2026 Location: 15 Kian Teck Crescent, Singapore 628884 Summary of Events CASA Holdings Limited conducted an Extraordinary General Meeting (EGM) attended by its Board of Directors, key finance and legal advisors, auditors, company secretary, and shareholders. The…

February 14, 2026

Sakae Holdings Ltd. HY2026 Financial Review: Navigating Uncertainty in F&B Sakae Holdings Ltd. has released its unaudited condensed interim financial statements for the six months ended 31 December 2025 (“HY2026”). The report provides insight into how the company is managing…

February 14, 2026

Singapore Paincare Holdings Limited (SGX: FRQ): HY2026 Interim Results Analysis Singapore Paincare Holdings Limited (“SPCH”) has released its unaudited interim consolidated financial statements for the six months ended 31 December 2025 ("HY2026"). This analysis reviews the key financial metrics, operational…

February 5, 2026

Key Transaction Overview GS Holdings Limited (“GS Holdings” or the “Company”) has announced its intention to divest its entire stake in its wholly-owned subsidiary, Hawkerway Pte. Ltd., to Wei Global Pte. Ltd. (“Buyer”) for a net cash consideration of S\$0.65…

February 5, 2026

GS Holdings Limited Proposes Name Change to Octopus (APAC) Holdings Limited GS Holdings Limited Proposes Strategic Name Change to Octopus (APAC) Holdings Limited Key Developments and Implications for Investors Highlights of the Announcement Proposed Name Change: GS Holdings Limited ("GS…

February 2, 2026

GS Holdings Limited Extends Long-Stop Date for Proposed Acquisition of Dyspatchr Pte. Ltd. GS Holdings Limited Extends Long-Stop Date for Proposed Acquisition of Dyspatchr Pte. Ltd. Key Highlights Extension of Long-Stop Date: GS Holdings Limited (“the Company”) has announced a…

December 3, 2025

GS Holdings Limited Completes Strike-Off of Wholly-Owned PRC Subsidiary Key Highlights GS Holdings Limited has completed the strike-off of its direct wholly-owned subsidiary, PMAS International Trading (Hainan) Co., Ltd., which is incorporated in the People’s Republic of China. The announcement…

November 4, 2025

GS Holdings to Acquire Dyspatchr Pte. Ltd. in Strategic All-Share Deal: Key Details Investors Must Know GS Holdings Unveils All-Share Acquisition of Dyspatchr Pte. Ltd.: Potential Game-Changer for F&B Sector Investors Summary: Major Strategic Move in Singapore’s F&B Distribution Market…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: 43A, GS Holdings Limited, GS Hldg, GSHL SP, GS HOLDINGS LTD, GS

February 16, 2026

Broker Name: Maybank Research Pte Ltd Date of Report: February 13, 2026 Excerpt from Maybank Research Pte Ltd report: Report Summary: Grab Holdings has provided rare long-term financial guidance, targeting a 20% revenue CAGR, USD1.5b adjusted EBITDA, and 80% free…

February 16, 2026

Broker Name: CGS International Securities Date of Report: February 13, 2026 Excerpt from CGS International Securities report. Report Summary iFAST Corporation Ltd delivered a strong 4Q25 with net profit up 70% year-on-year, exceeding both CGS and consensus expectations. Strong performance…

February 16, 2026

Broker Name: CGS International Date of Report: February 13, 2026 Excerpt from CGS International report. Report Summary BRC Asia Ltd's 1QFY26 profit after tax and minority interests (PATMI) rose 48% year-on-year to S\$28.8m, beating expectations due to higher sales volumes,…

February 16, 2026

Broker name: CGS International Securities Date of report: February 13, 2026 Excerpt from CGS International Securities report. Report Summary: ISOTeam Ltd's 1HFY26 profits rose 70% year-on-year to S\$3.3m, fueled by margin recovery and cost savings from housing workers at its…

February 16, 2026

Broker Name: CGS International Date of Report: February 13, 2026 Excerpt from CGS International report. Report Summary: BRC Asia Ltd posted strong 1QFY26 results, with PATMI of S\$28.8m (+48% yoy), driven by higher sales volumes, economies of scale, and lower…

February 15, 2026

China Sunsine Chemical Holdings Ltd.: FY2025 Financial Announcement & Company Overview China Sunsine Chemical Holdings Ltd. has issued an announcement regarding the release of its unaudited interim financial statements for the second half and full year ended 31 December 2025.…

February 14, 2026

Casa Holdings Limited: 2026 AGM Review – Key Developments and Investor Insights Casa Holdings Limited held its Annual General Meeting (AGM) on 23 January 2026 at its Singapore headquarters. The event provided shareholders and stakeholders with valuable insights into the…

February 14, 2026

Date: 23 January 2026 Location: 15 Kian Teck Crescent, Singapore 628884 Summary of Events CASA Holdings Limited conducted an Extraordinary General Meeting (EGM) attended by its Board of Directors, key finance and legal advisors, auditors, company secretary, and shareholders. The…

February 14, 2026

Sakae Holdings Ltd. HY2026 Financial Review: Navigating Uncertainty in F&B Sakae Holdings Ltd. has released its unaudited condensed interim financial statements for the six months ended 31 December 2025 (“HY2026”). The report provides insight into how the company is managing…

February 14, 2026

Singapore Paincare Holdings Limited (SGX: FRQ): HY2026 Interim Results Analysis Singapore Paincare Holdings Limited (“SPCH”) has released its unaudited interim consolidated financial statements for the six months ended 31 December 2025 ("HY2026"). This analysis reviews the key financial metrics, operational…

February 5, 2026

Key Transaction Overview GS Holdings Limited (“GS Holdings” or the “Company”) has announced its intention to divest its entire stake in its wholly-owned subsidiary, Hawkerway Pte. Ltd., to Wei Global Pte. Ltd. (“Buyer”) for a net cash consideration of S\$0.65…

February 5, 2026

GS Holdings Limited Proposes Name Change to Octopus (APAC) Holdings Limited GS Holdings Limited Proposes Strategic Name Change to Octopus (APAC) Holdings Limited Key Developments and Implications for Investors Highlights of the Announcement Proposed Name Change: GS Holdings Limited ("GS…

February 2, 2026

GS Holdings Limited Extends Long-Stop Date for Proposed Acquisition of Dyspatchr Pte. Ltd. GS Holdings Limited Extends Long-Stop Date for Proposed Acquisition of Dyspatchr Pte. Ltd. Key Highlights Extension of Long-Stop Date: GS Holdings Limited (“the Company”) has announced a…

December 3, 2025

GS Holdings Limited Completes Strike-Off of Wholly-Owned PRC Subsidiary Key Highlights GS Holdings Limited has completed the strike-off of its direct wholly-owned subsidiary, PMAS International Trading (Hainan) Co., Ltd., which is incorporated in the People’s Republic of China. The announcement…

November 4, 2025

GS Holdings to Acquire Dyspatchr Pte. Ltd. in Strategic All-Share Deal: Key Details Investors Must Know GS Holdings Unveils All-Share Acquisition of Dyspatchr Pte. Ltd.: Potential Game-Changer for F&B Sector Investors Summary: Major Strategic Move in Singapore’s F&B Distribution Market…

![text

Download

Copy code

1Okay, here’s an attempt to create an SEO title and answer potential user questions based on the provided document:

2

3**SEO title:**

4SEO title: SATS Ltd (SATS SP): Embedded Resilience & FY26F Outlook – CGS International Analysis

5

6**Analysis based on the document:**

7

8Based on the document provided, here’s a summary of key points and potential user questions with answers:

9

10**Key Points:**

11

12* **Company:** SATS Ltd (SATS SP)

13* **Recommendation:** Reiterate Add

14* **Analyst:** TAY Wee Kuang and LIM Siew Khee, CGS International

15* **Key Themes:** Embedded resilience, cargo market share gains, FY26F outlook

16* **Target Price:** S\$3.60

17* **ESG:** Rated B- by LSEG

18

19**Potential User Questions & Answers:**

20

21**Q: What is the overall recommendation for SATS Ltd?**

22A: CGS International reiterates an “Add” recommendation for SATS Ltd. [[1]]

23

24**Q: What is the target price for SATS Ltd, and who set it?**

25A: The target price is S\$3.60, set by CGS International. [[1]]

26

27**Q: What is the basis for the target price?**

28A: The target price is DCF-based (Discounted Cash Flow), with a WACC of 12.2%. [[1]]

29

30**Q: What are the key factors driving the “Add” recommendation?**

31A: The key factor is SATS’s growing market share in cargo handling, which is expected to support earnings growth in FY26F, even with potential global cargo demand weakness. [[1]]

32

33**Q: What is SATS’s ESG rating?**

34A: SATS has an ESG combined score of B- by LSEG. [[1, 5]]

35

36**Q: What were SATS’s 4QFY3/25 financial results?**

37A: SATS reported a 4QFY3/25 net profit of S\$38.7m (+18.3% yoy). Revenue was S\$1.48bn (+10.4% yoy). [[1]]

38

39**Q: What are the potential risks to SATS’s performance?**

40A: Downside risks include margin compression from weaker operating leverage due to softening cargo volumes and a decline in the aviation travel industry due to an economic downturn. [[1]]

41

42**Q: What is the dividend payout?**

43A: SATS declared a final DPS of 3.5 Scts, bringing FY25 total DPS to 5.0 Scts, representing a payout ratio of 30.6%. [[1]]

44

45**Q: What is the earnings growth outlook?**

46A: The report anticipates a 3-year earnings CAGR of 15.0%. [[1]]

47

48**Q: Has the analyst revised earnings estimates?**

49A: Yes, FY26F-27F EPS estimates have been increased by 7.9-8.5%. FY28F estimates are introduced. [[1]]

50

51**Q: What are the catalysts for a potential re-rating?**

52A: Potential re-rating catalysts include an expanded footprint for cargo operations supporting new contract wins and a faster step-up in utilization of its new central kitchens across China and India. [[1]]

53

54**Q: What is SATS’s market capitalization?**

55A: The market cap is US\$3,444m / S\$4,428m. [[1]]

56

57**Q: Who are the major shareholders of SATS?**

58A: Temasek Holdings is a major shareholder, holding 40.4%. [[1]]

59

60**Q: What is SATS’s revenue in Mar-25A?**

61A: SATS’s revenue in Mar-25A is S\$5,821 million. [[1]]

62

63**Q: What are the peers of SATS?**

64A: Airports of Thailand is a peer. [[4]]

65

66**Q: What is the forecast dividend yield for Mar-26F?**

67A: The forecast dividend yield for Mar-26F is 1.85%. [[1]]](https://www.minichart.com.sg/wp-content/uploads/2025/05/SATS-Ltd-1.png)

May 26, 2025

CGS International May 26, 2025 SATS Ltd: Embedded Resilience to Tide Through FY26F Key Takeaways from SATS Ltd's 4QFY3/25 Performance SATS Ltd reported a 4QFY3/25 net profit of S\$38.7m, which is an 18.3% year-over-year increase. This figure slightly exceeded the…

April 12, 2025

GS Holdings Limited: Net Profit Decline of $801,000 - A Comprehensive Analysis Company Overview GS Holdings Limited is a Singapore-registered company incorporated in the Republic of Singapore. The company's core business operations, business segments, and geographic footprint are not explicitly…

April 12, 2025

Financial Analysis Report: GS Holdings Limited Date: 11 April 2025 Financial Year: 2024 Net Profit Growth/Decline: Not explicitly stated, but the company's financial performance is discussed. Company Overview GS Holdings Limited is a Singapore-incorporated company with a core business operation…

February 26, 2025

Net Loss Decline: Q4 Loss Down 83% and Annual Loss Down 87% – Financial Analysis of GS Holdings Limited Net Loss Decline: Q4 Loss Down 83% and Annual Loss Down 87% – Financial Analysis of GS Holdings Limited Reporting Date:…

October 9, 2024

Key Points and Investor Actions:Rights Issue Overview:GS Holdings Limited is offering a renounceable non-underwritten rights issue of up to 570,888,708 new ordinary shares at an issue price of S$0.015 per Rights Share. The ratio is two (2) Rights Shares for…