📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

50-100%

- Net Income Growth Range (1Y):

50-100%

- Revenue Growth Range (1Y):

10-25%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

1.53%

📅 SGX Earnings Announcements for 42N

IPS Securex Holdings Limited (42N)

Market: SGX |

Currency: SGD

Address: No 04-09 Henderson Industrial Park

IPS Securex Holdings Limited, through its subsidiaries, provides security products and integrated security solutions to commercial entities, and government bodies and agencies. It operates through two segments, Security Solutions; and Maintenance and Leasing. The company offers security products and integrated security solutions to address various security requirements, including checkpoint security, law enforcement, and the protection and surveillance of buildings and critical infrastructure. It also provides homeland security products, including acoustic hailing devices, cargo scanning systems, CBRNE equipment and solutions, non-lethal countermeasure systems, surveillance radar systems, and vehicle inspection systems. In addition, the company offers general security products, such as access control solutions that prevent unauthorized access and restrict access to sensitive areas; video monitoring solutions for investigation and deterrence of incidents that cause harm, loss, and damage; and mass notification products for public announcement and to evacuate people in emergency situations, as well as other enhancements comprises background music and hearing assistive technology for the hearing impaired. Further, it provides customer, maintenance, project management, repair, technical, and training services, as well as spare parts. The company operates in Singapore, the People's Republic of China, South Korea, Japan, Myanmar, Thailand, Laos, Cambodia, Vietnam, Malaysia, Brunei, Indonesia, the Philippines, Timor-Leste, and internationally. IPS Securex Holdings Limited was founded in 1986 and is headquartered in Singapore. IPS Securex Holdings Limited is a subsidiary of IPS Technologies Pte. Ltd.

Show more

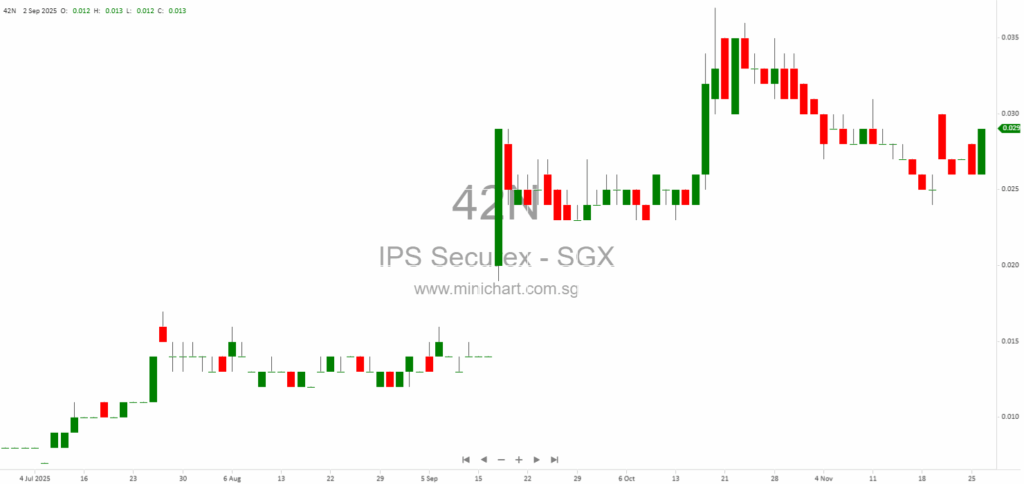

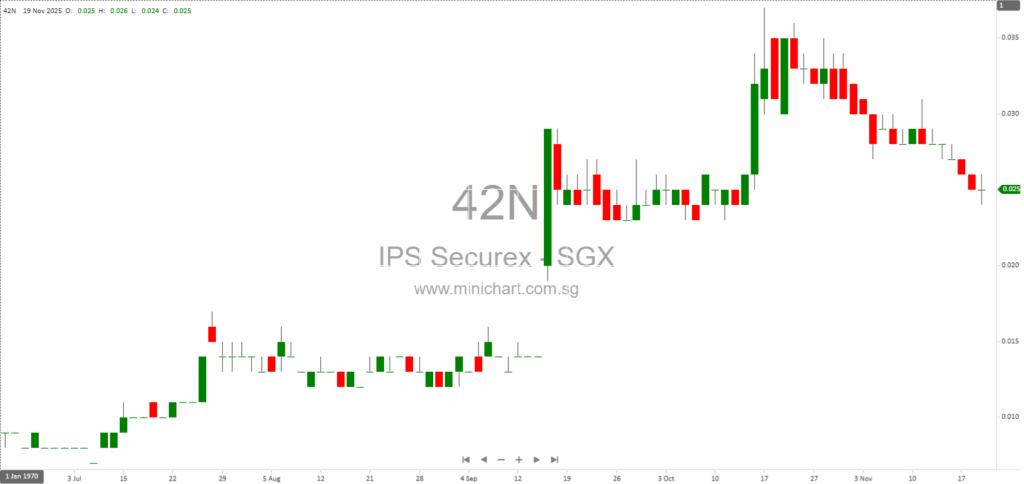

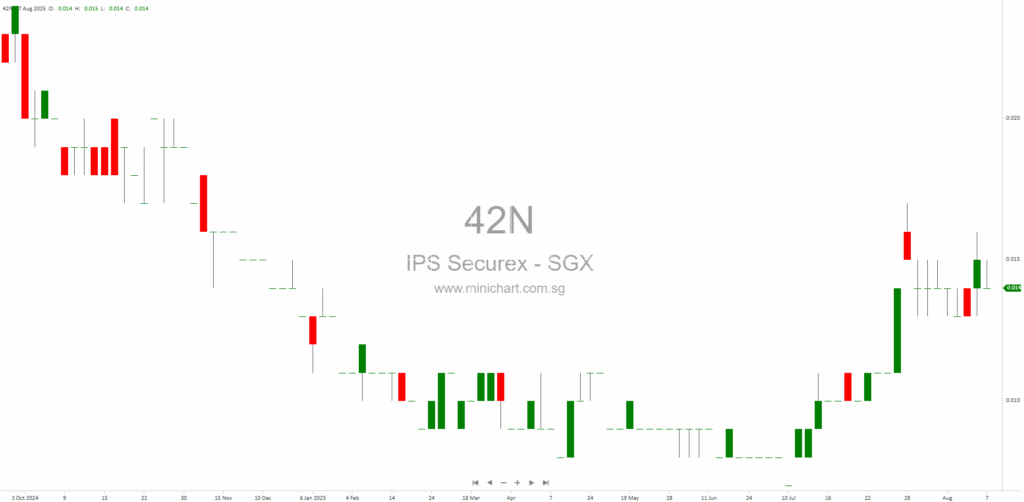

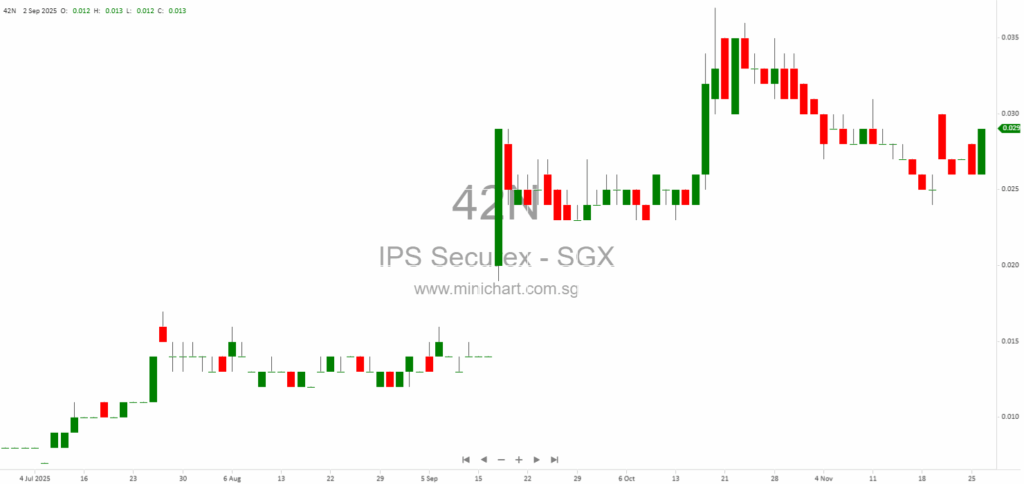

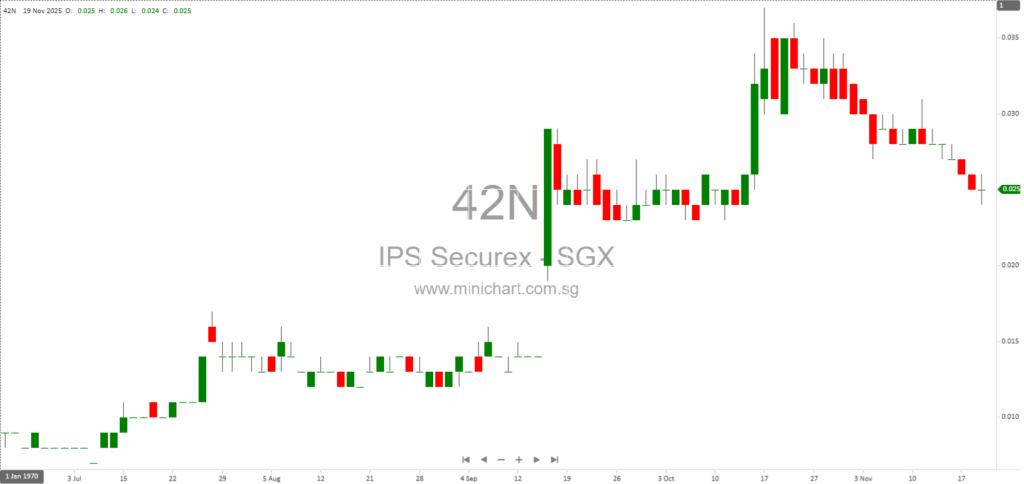

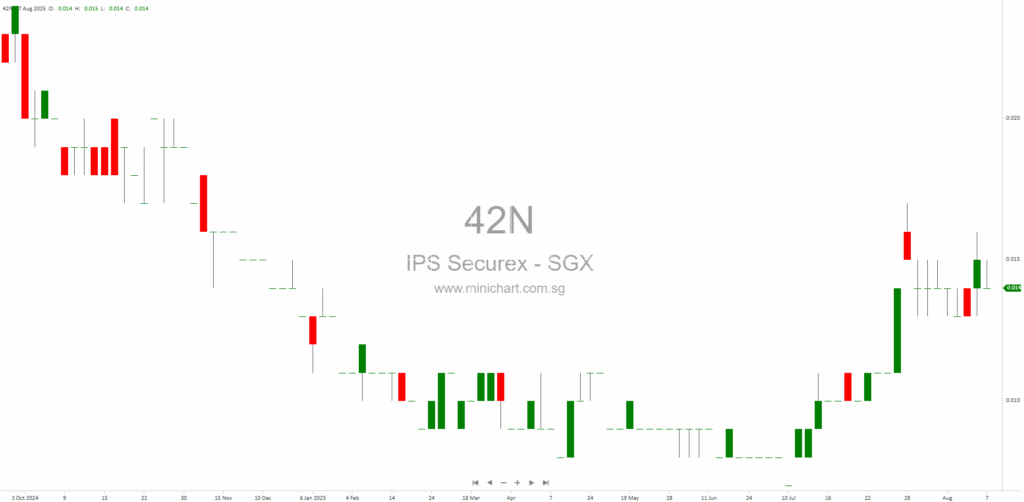

📈 IPS Securex Holdings Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 11, 2026

IPS Securex Holdings Limited 1H-2026 Financial Results: Strong Revenue Surge but Challenges Remain IPS Securex Holdings Limited (the "Group") delivered its condensed interim financial statements for the six months ended 31 December 2025, highlighting a strong rebound in revenue and…

December 17, 2025

IPS Securex Holdings Limited Secures S\$1.7 Million Contract IPS Securex Holdings Limited Secures S\$1.7 Million Contract for Security Systems Key Highlights Contract Awarded: IPS Securex Holdings Limited’s wholly-owned subsidiary, Securex GS Pte. Ltd., has been awarded a purchase order valued…

November 26, 2025

IPS Securex Holdings Limited AGM 2025: Key Takeaways for Investors IPS Securex Holdings Limited AGM 2025: Key Takeaways for Investors Overview of Annual General Meeting (AGM) IPS Securex Holdings Limited held its Annual General Meeting (AGM) on 28 October 2025,…

November 20, 2025

IPS Securex Holdings Secures S\$5.8 Million Contract Variation for Integrated Security Solutions IPS Securex Holdings Secures S\$5.8 Million Contract Variation for Integrated Security Solutions Overview and Key Developments IPS Securex Holdings Limited ("IPS Securex" or the "Company") has announced a…

August 7, 2025

IPS Securex Holdings Limited: Profit Guidance for FY2025 IPS Securex Holdings Limited has released a profit guidance announcement for the financial year ended 30 June 2025 (FY2025). The company, which operates in the security solutions and maintenance business in Singapore…

January 27, 2025

IPS Securex Holdings: Net Profit Decline and Investment Recommendations IPS Securex Holdings: Net Profit Decline and Investment Recommendations Business Description IPS Securex Holdings Limited, incorporated in Singapore, operates as a provider of security solutions and maintenance support services across Southeast…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: 42N, IPS Securex Holdings Limited, IPS Securex, IPSS SP, IPS SECUREX HOLDINGS LTD, IPS SECUREX

February 11, 2026

IPS Securex Holdings Limited 1H-2026 Financial Results: Strong Revenue Surge but Challenges Remain IPS Securex Holdings Limited (the "Group") delivered its condensed interim financial statements for the six months ended 31 December 2025, highlighting a strong rebound in revenue and…

December 17, 2025

IPS Securex Holdings Limited Secures S\$1.7 Million Contract IPS Securex Holdings Limited Secures S\$1.7 Million Contract for Security Systems Key Highlights Contract Awarded: IPS Securex Holdings Limited’s wholly-owned subsidiary, Securex GS Pte. Ltd., has been awarded a purchase order valued…

November 26, 2025

IPS Securex Holdings Limited AGM 2025: Key Takeaways for Investors IPS Securex Holdings Limited AGM 2025: Key Takeaways for Investors Overview of Annual General Meeting (AGM) IPS Securex Holdings Limited held its Annual General Meeting (AGM) on 28 October 2025,…

November 20, 2025

IPS Securex Holdings Secures S\$5.8 Million Contract Variation for Integrated Security Solutions IPS Securex Holdings Secures S\$5.8 Million Contract Variation for Integrated Security Solutions Overview and Key Developments IPS Securex Holdings Limited ("IPS Securex" or the "Company") has announced a…

October 3, 2025

Broker: CGS International Date of Report: October 3, 2025 Excerpt from CGS International report. Report Summary CGS International highlights a bullish technical reversal for IPS Securex Holdings Ltd, with strong technical signals such as a cup and handle formation, bullish…

August 7, 2025

IPS Securex Holdings Limited: Profit Guidance for FY2025 IPS Securex Holdings Limited has released a profit guidance announcement for the financial year ended 30 June 2025 (FY2025). The company, which operates in the security solutions and maintenance business in Singapore…

January 27, 2025

IPS Securex Holdings: Net Profit Decline and Investment Recommendations IPS Securex Holdings: Net Profit Decline and Investment Recommendations Business Description IPS Securex Holdings Limited, incorporated in Singapore, operates as a provider of security solutions and maintenance support services across Southeast…

October 10, 2024

Report Summary and Key Points for Investor Actions: IPS Securex Holdings Limited (FY2024)Report Date and Financial Year:The report is for the financial year ending 30th June 2024.Revenue and Financial Performance:Revenue increased by 18.6%, from S$11.5 million in FY2023 to S$13.7…