📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

0.37%

Amount: $0.000000

Yield: -

Pay Date: -

Details:

Ratio: 2:1

📅 SGX Earnings Announcements for 1L2

N/A (1L2)

Market: SGX |

Currency: SGD

Address: 28 Tuas Crescent

Hiap Seng Industries Limited, an investment holding company, engages in the provision of engineering, procurement, construction, and plant maintenance services for oil and gas, and energy sectors. The company provides building construction, process piping, pressure vessels, process equipment installation, modular compression, and tanks and terminals services for oil and gas, petrochemical and chemical, power and utilities, and pharmaceutical industries. It offers routine daily maintenance, total integrated plant maintenance, and turnaround maintenance services in the refineries, petrochemical/chemical complexes, pharmaceutical, and power/utilities plants; undertakes mechanical, E & I and civil/buildings, refractory, insulation, and blasting/painting works, as well as scaffolding services. In addition, the company engages in the provision of mechanical engineering, plant fabrication, installation, and plant maintenance services for the petroleum and petrochemical industries, as well as provision of process and industrial plant engineering, and consultancy services. It serves Singapore, the United Arab Emirates, and internationally. The company was founded in 1950 and is headquartered in Singapore.

Show more

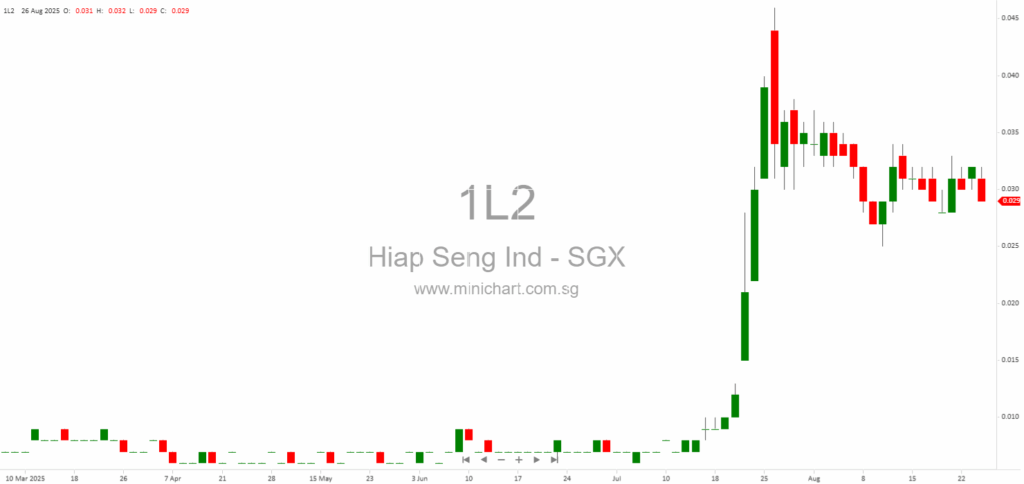

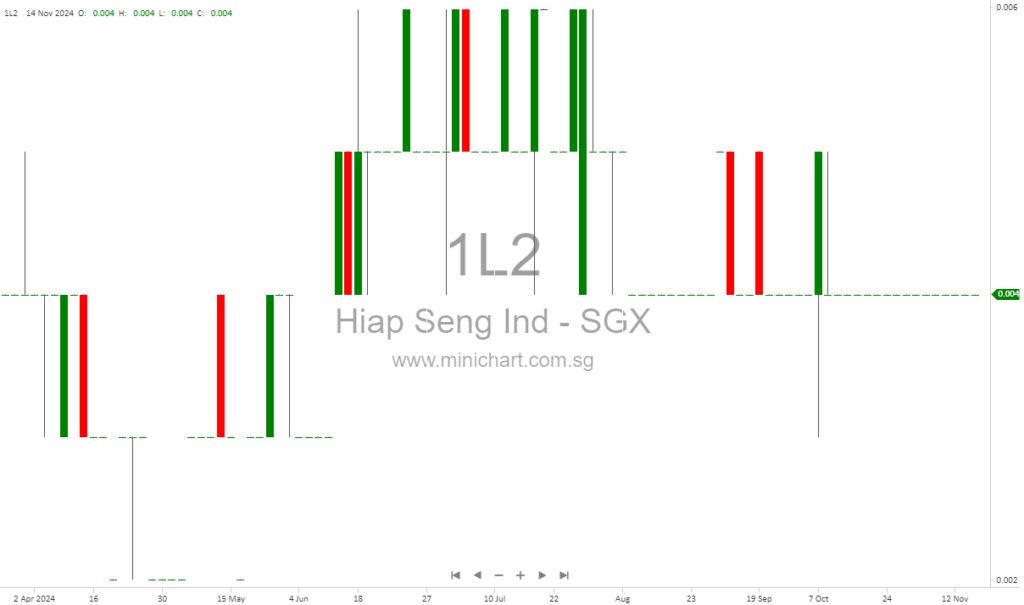

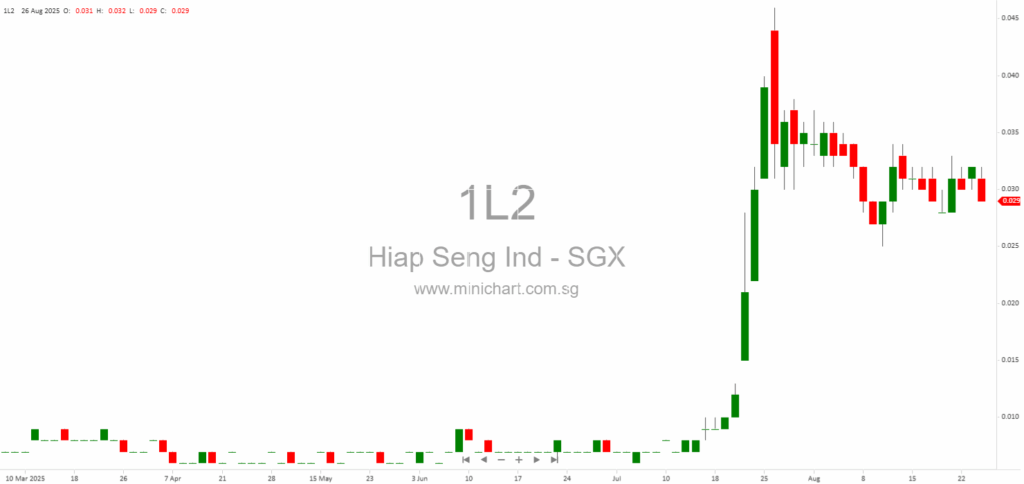

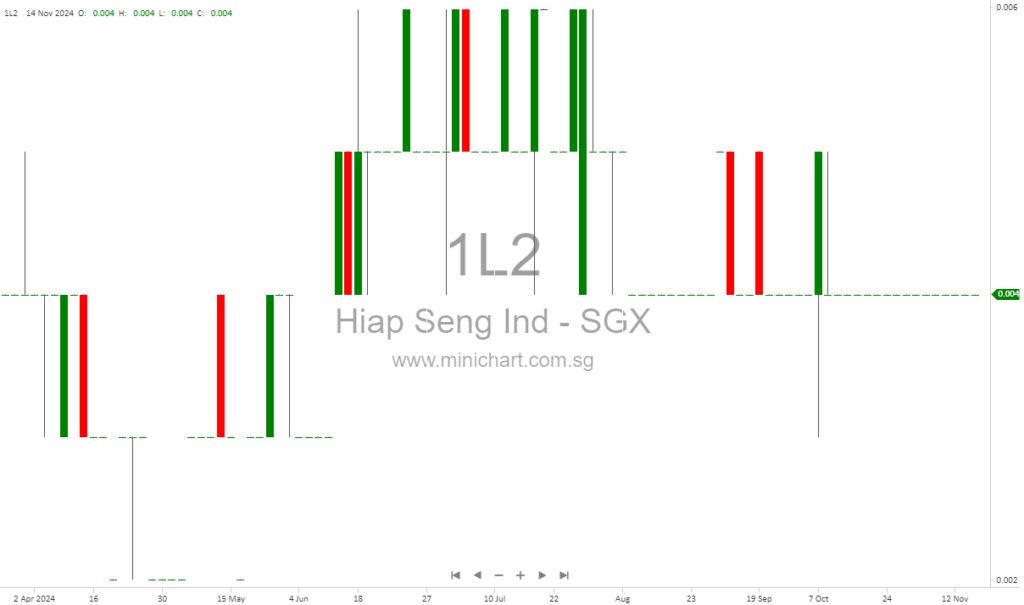

📈 N/A Historical Chart

🧾 Recent Financial Statement Analysis

January 2, 2026

Key Points from the Announcement Incorporation Date: 2 January 2026 New Subsidiary: Hiap Seng Energy Technology Pte. Ltd. ("HSET") Ownership: Wholly-owned by Hiap Seng Industries Limited Location: Singapore Business Activities: HSET will act as a general contractor for building construction,…

August 26, 2025

Hiap Seng Industries AGM 2025: New Substantial Shareholder, Capital Reduction Exercise, and Expansion Plans Signal Potential Shifts Key Highlights from Hiap Seng Industries Limited's 2025 Annual General Meeting (AGM) Hiap Seng Industries Limited held its Annual General Meeting on 30…

November 15, 2024

Financial Analysis: Net Profit Growth of 339% - Hiap Seng Industries Limited Financial Analysis: Net Profit Growth of 339% - Hiap Seng Industries Limited Business Description Hiap Seng Industries Limited is an investment holding company primarily involved in building construction,…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: 1L2, N/A, Hiap Seng Ind, HSIND SP, HIAP SENG INDUSTRIES LTD, HIAP SENG INDUSTRIES

January 2, 2026

Key Points from the Announcement Incorporation Date: 2 January 2026 New Subsidiary: Hiap Seng Energy Technology Pte. Ltd. ("HSET") Ownership: Wholly-owned by Hiap Seng Industries Limited Location: Singapore Business Activities: HSET will act as a general contractor for building construction,…

August 26, 2025

Hiap Seng Industries AGM 2025: New Substantial Shareholder, Capital Reduction Exercise, and Expansion Plans Signal Potential Shifts Key Highlights from Hiap Seng Industries Limited's 2025 Annual General Meeting (AGM) Hiap Seng Industries Limited held its Annual General Meeting on 30…

November 15, 2024

Financial Analysis: Net Profit Growth of 339% - Hiap Seng Industries Limited Financial Analysis: Net Profit Growth of 339% - Hiap Seng Industries Limited Business Description Hiap Seng Industries Limited is an investment holding company primarily involved in building construction,…