📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-02-25

💰 Dividend History

Current year to date yield:

9.17%

📅 SGX Earnings Announcements for XZL

Acrophyte Hospitality Trust (XZL)

Market: SGX |

Currency: USD

Address: 10 Anson Road, #23-15

Acrophyte Hospitality Trust (formerly known as ARA US Hospitality Trust) is a hospitality stapled group comprising Acrophyte Hospitality Property Trust (formerly known as ARA US Hospitality Property Trust) and Acrophyte Hospitality Management Trust (formerly known as ARA US Hospitality Management Trust). ACRO-HT invests in income-producing real estate assets used primarily for hospitality purposes located in the United States. As at the date of this announcement, ACRO-HTs portfolio comprises 32 select-service hotels with a total of 4,188 rooms across 17 states in the United States. ACRO-HT is managed by Acrophyte Hospitality Trust Management Pte. Ltd. (formerly known as ARA Trust Management (USH) Pte. Ltd.) and Acrophyte Hospitality Business Trust Management Pte. Ltd. (formerly known as ARA Business Trust Management (USH) Pte. Ltd.), collectively known as the. The Managers are wholly-owned subsidiaries of Acrophyte Asset Management Pte Ltd.

Show more

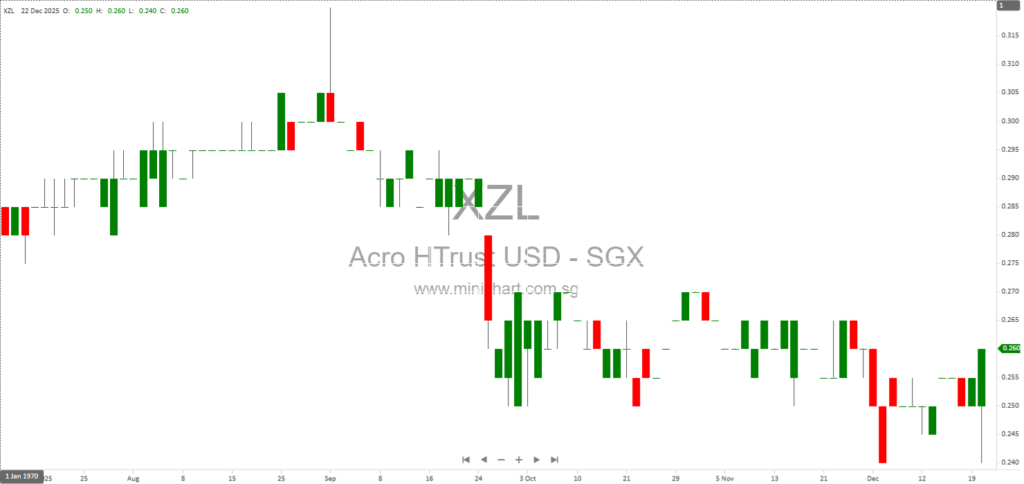

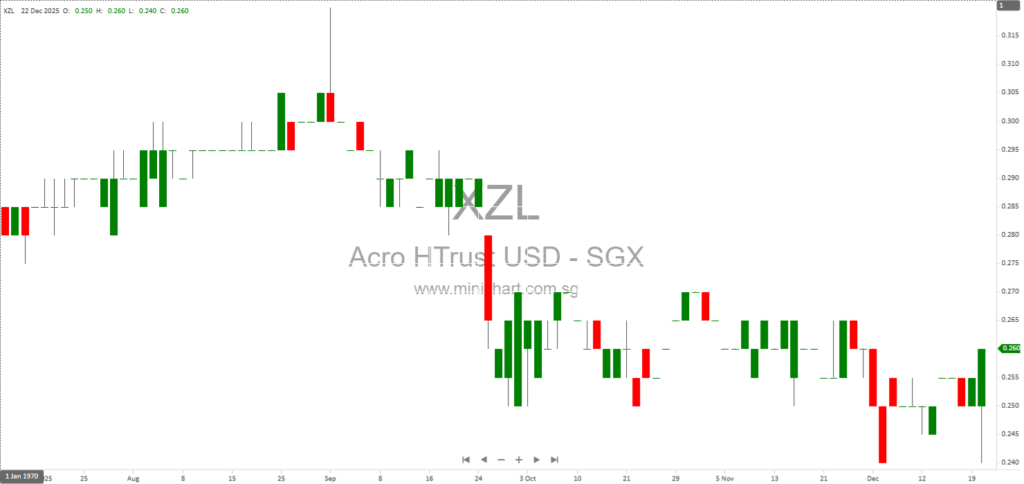

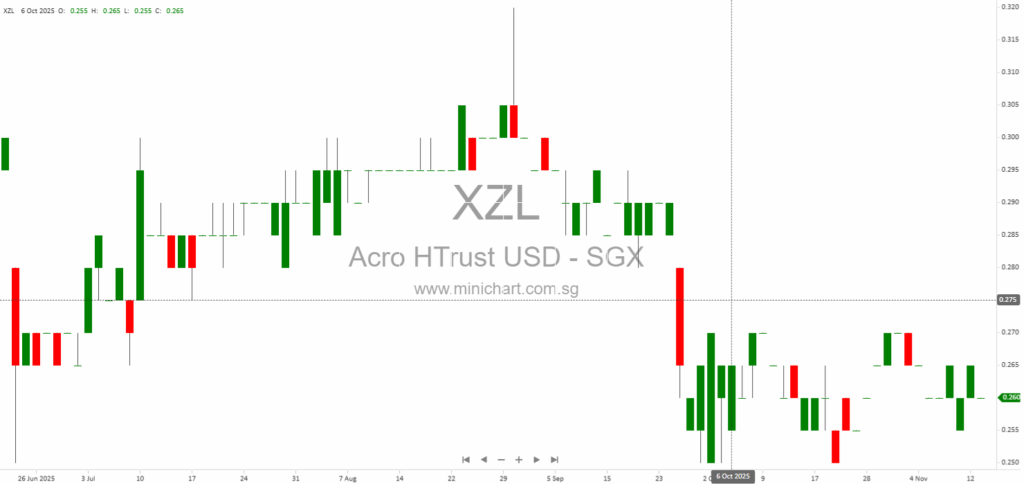

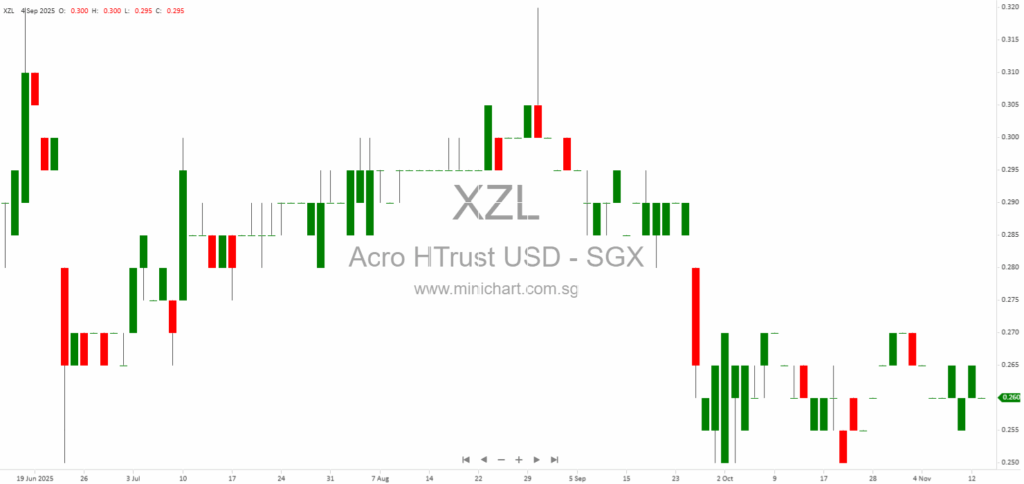

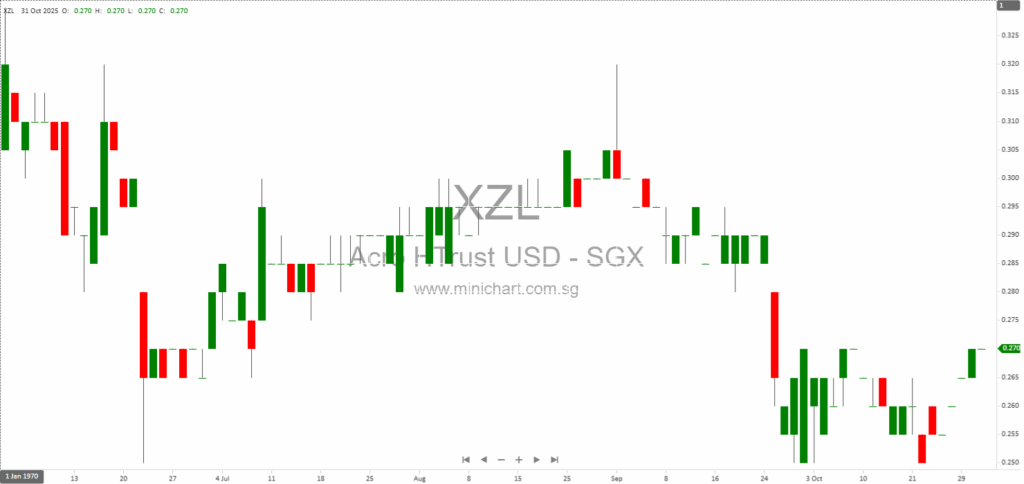

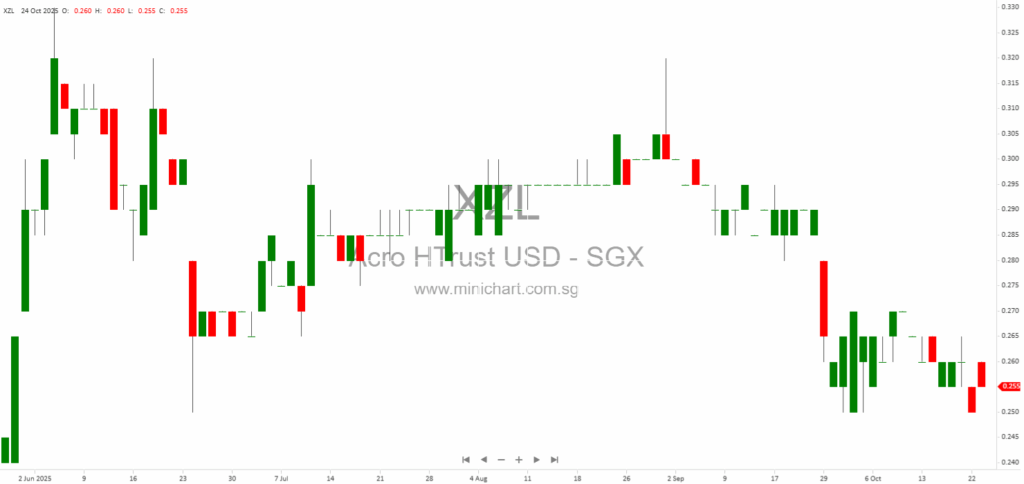

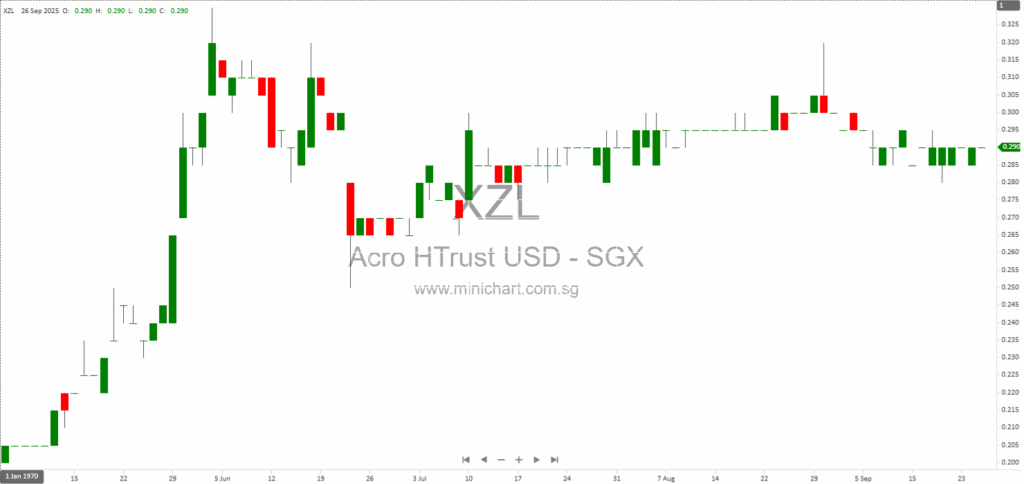

📈 Acrophyte Hospitality Trust Historical Chart

🧾 Recent Financial Statement Analysis

January 23, 2026

Acrophyte Hospitality Trust: Financial Results and Business Update Acrophyte Hospitality Trust (ACRO-HT), a stapled group listed on the Singapore Exchange since May 2019, has announced that it will release its financial results for the half year and full year ended…

January 21, 2026

Acrophyte Hospitality Trust Provides Update on Strategic Review – Key Developments for Investors Acrophyte Hospitality Trust: Ongoing Strategic Review and Potential Transaction Update Singapore, 21 January 2026 – Acrophyte Hospitality Trust ("ACRO-HT"), a stapled group listed on the Singapore Exchange,…

December 22, 2025

Details About Acrophyte Hospitality Trust Listed Entity: ACRO-HT has been listed on the Singapore Exchange since May 2019. It is a stapled group comprising Acrophyte Hospitality Property Trust (ACRO-REIT) and Acrophyte Hospitality Management Trust (ACRO-BT). Portfolio Composition: ACRO-HT’s portfolio consists…

December 18, 2025

Acrophyte Hospitality Trust Announces Proposed Sale of Hyatt Place Memphis Primacy Parkway Acrophyte Hospitality Trust Announces Proposed Sale of Hyatt Place Memphis Primacy Parkway Key Highlights Proposed Sale: Acrophyte Hospitality Trust (ACRO-HT) has entered into a conditional purchase and sale…

December 9, 2025

Acrophyte Hospitality Trust Announces Divestment of Hyatt Place Detroit Livonia Acrophyte Hospitality Trust Announces US\$10 Million Divestment of Hyatt Place Detroit Livonia Key Points Proposed Sale: Acrophyte Hospitality Trust (ACRO-HT), through its wholly-owned subsidiary, has entered into a conditional purchase…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: XZL, Acrophyte Hospitality Trust

January 23, 2026

Acrophyte Hospitality Trust: Financial Results and Business Update Acrophyte Hospitality Trust (ACRO-HT), a stapled group listed on the Singapore Exchange since May 2019, has announced that it will release its financial results for the half year and full year ended…

January 21, 2026

Acrophyte Hospitality Trust Provides Update on Strategic Review – Key Developments for Investors Acrophyte Hospitality Trust: Ongoing Strategic Review and Potential Transaction Update Singapore, 21 January 2026 – Acrophyte Hospitality Trust ("ACRO-HT"), a stapled group listed on the Singapore Exchange,…

December 22, 2025

Details About Acrophyte Hospitality Trust Listed Entity: ACRO-HT has been listed on the Singapore Exchange since May 2019. It is a stapled group comprising Acrophyte Hospitality Property Trust (ACRO-REIT) and Acrophyte Hospitality Management Trust (ACRO-BT). Portfolio Composition: ACRO-HT’s portfolio consists…

December 18, 2025

Acrophyte Hospitality Trust Announces Proposed Sale of Hyatt Place Memphis Primacy Parkway Acrophyte Hospitality Trust Announces Proposed Sale of Hyatt Place Memphis Primacy Parkway Key Highlights Proposed Sale: Acrophyte Hospitality Trust (ACRO-HT) has entered into a conditional purchase and sale…

December 9, 2025

Acrophyte Hospitality Trust Announces Divestment of Hyatt Place Detroit Livonia Acrophyte Hospitality Trust Announces US\$10 Million Divestment of Hyatt Place Detroit Livonia Key Points Proposed Sale: Acrophyte Hospitality Trust (ACRO-HT), through its wholly-owned subsidiary, has entered into a conditional purchase…

November 13, 2025

Acrophyte Hospitality Trust Q3 2025 Operational and Financial Update: Key Highlights for Investors Acrophyte Hospitality Trust Q3 2025 Operational and Financial Update Key Points and Investor Highlights Portfolio Realignment and Revenue Decline: Acrophyte Hospitality Trust (“ACRO-HT”) reported a 6.3% year-on-year…

November 13, 2025

Acrophyte Hospitality Trust 3Q 2025: Business & Operational Update Acrophyte Hospitality Trust 3Q 2025 – Business & Operational Update: Key Takeaways for Investors U.S. Economic and Lodging Market Overview U.S. Economic Growth Moderates: For 3Q 2025, U.S. GDP growth is…

October 31, 2025

Acrophyte Hospitality Trust: Q3 2025 Business Update Announcement Acrophyte Hospitality Trust to Release Q3 2025 Operational Update: What Investors Need to Watch Key Developments and Strategic Positioning Could Impact Shareholder Value Acrophyte Hospitality Trust (“ACRO-HT”), a stapled group listed on…

October 24, 2025

Acrophyte Hospitality Trust in Strategic Review: What Investors Must Know Now Acrophyte Hospitality Trust Undertakes Strategic Review: Investors Brace for Potential Major Changes Key Developments and What They Mean for Stapled Securityholders Acrophyte Hospitality Trust (“ACRO-HT”), a Singapore-listed hospitality stapled…

September 27, 2025

Acrophyte Hospitality Trust Faces US\$100 Million Capex Hurdle Amid Weak Trading, Considers Major Strategic Options Acrophyte Hospitality Trust Faces US\$100 Million Capex Hurdle Amid Weak Trading, Considers Major Strategic Options Key Points from the Strategic Review Update Massive US\$100 Million…