📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

3.64%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-02-23

💰 Dividend History

Current year to date yield:

4.74%

📅 SGX Earnings Announcements for J2T

Hock Lian Seng Holdings Limited (J2T)

Market: SGX |

Currency: SGD

Address: No.16-08 Parkway Parade

Hock Lian Seng Holdings Limited, an investment holding company, primarily provides civil engineering services to public and private sectors in Singapore. It operates through three segments: Civil Engineering, Properties Development, and Properties Investment. The Civil Engineering segment engages in infrastructure construction and civil engineering works for bridges, expressways, tunnels, mass rapid transit, port facilities, water and sewage facilities, and other infrastructure works to government and government related bodies. Its Properties Development segment develops properties in the residential and industrial sectors. The Properties Investment segment invests in properties for renting and/or for capital appreciation and others. Hock Lian Seng Holdings Limited was founded in 1969 and is based in Singapore.

Show more

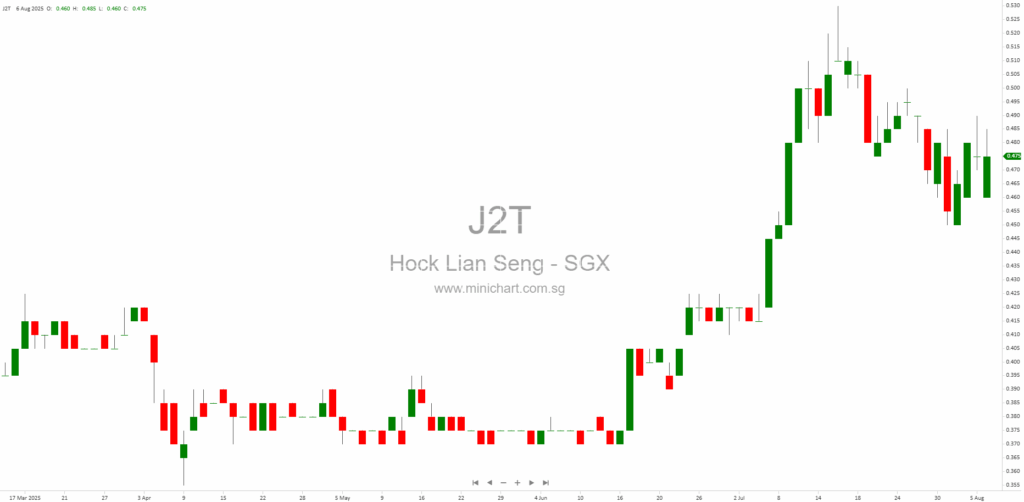

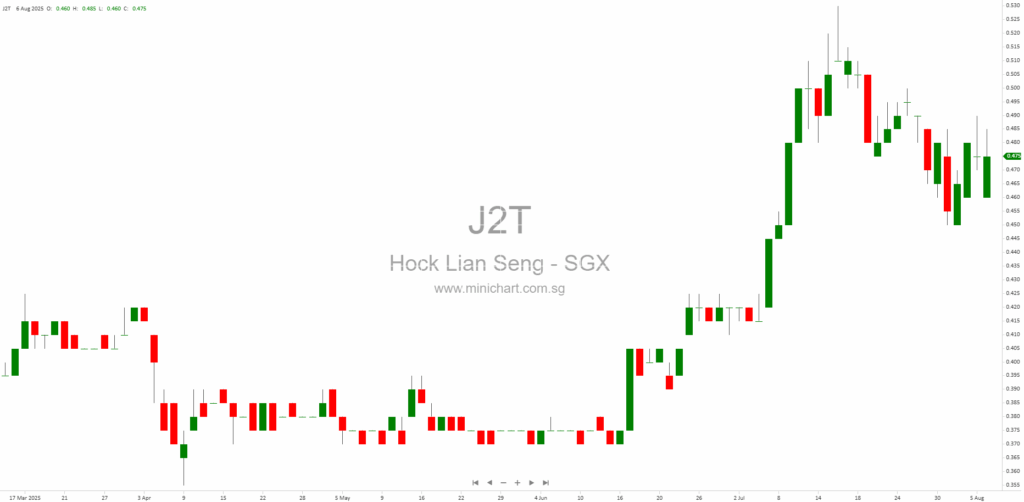

📈 Hock Lian Seng Holdings Limited Historical Chart

🧾 Recent Financial Statement Analysis

August 6, 2025

Hock Lian Seng Holdings Limited: 1H 2025 Financial Results Review Hock Lian Seng Holdings Limited (“HLS”), a Singapore-listed company with core operations in civil engineering, property development, and property investment, released its unaudited condensed interim financial statements for the six…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: J2T, Hock Lian Seng Holdings Limited, Hock Lian Seng, HLSH SP, HOCK LIAN SENG HOLDINGS LTD, HOCK LIAN SENG

August 6, 2025

Hock Lian Seng Holdings Limited: 1H 2025 Financial Results Review Hock Lian Seng Holdings Limited (“HLS”), a Singapore-listed company with core operations in civil engineering, property development, and property investment, released its unaudited condensed interim financial statements for the six…

July 9, 2025

Broker: CGS International Date of Report: July 9, 2025 Hock Lian Seng Holdings: Technical Buy Signal Amid Bullish Momentum and Global Trade Volatility Market Recap: Volatility Returns as Trade Tensions Escalate Global stock markets are showing signs of strain as…