📊 Statistics

- Analyst 1 Year Price Target:

$0.31

- Upside/Downside from Analyst Target:

33.33%

- Broker Call:

5

- Dividend Minimum 3 Year Yield:

3.38%

- EPS Growth Range (1Y):

100-200%

- Net Income Growth Range (1Y):

100-200%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-02-17

💰 Dividend History

Current year to date yield:

1.40%

📅 SGX Earnings Announcements for OXMU

Prime US REIT (OXMU)

Market: SGX |

Currency: USD

Address: 1 Raffles Place

Listed on 19 July 2019 on the Main Board of the Singapore Exchange, Prime US REIT (?PRIME?) is a well-diversified real estate investment trust ("REIT") focused on stabilised income-producing office assets in the United States ("U.S."). With the objectives to achieve long-term growth in distributions per unit and net asset value per unit while maintaining a robust capital structure, PRIME offers investors unique exposure to a high-quality portfolio of 14 Class A freehold office properties which are strategically located in 13 key U.S. office markets. PRIME's portfolio has a total carrying value of US$1.41 billion as at 31 December 2023.

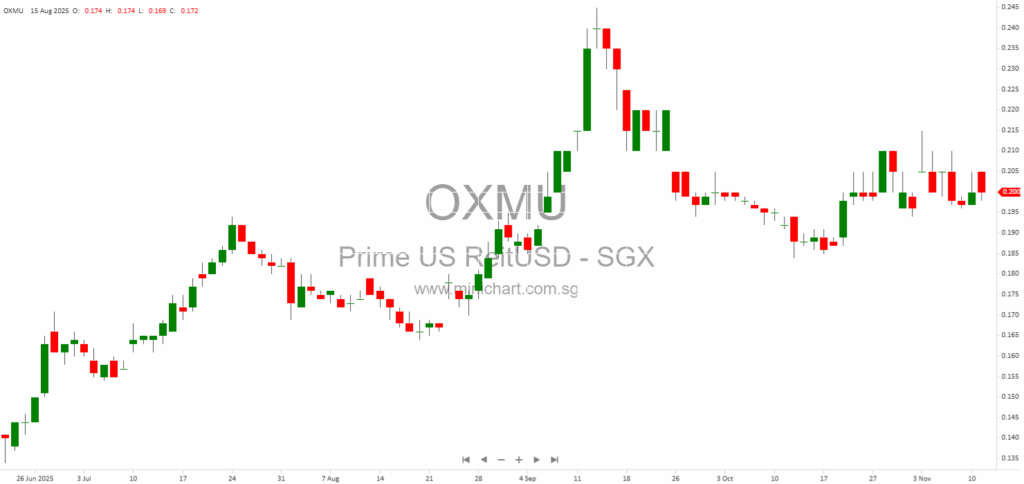

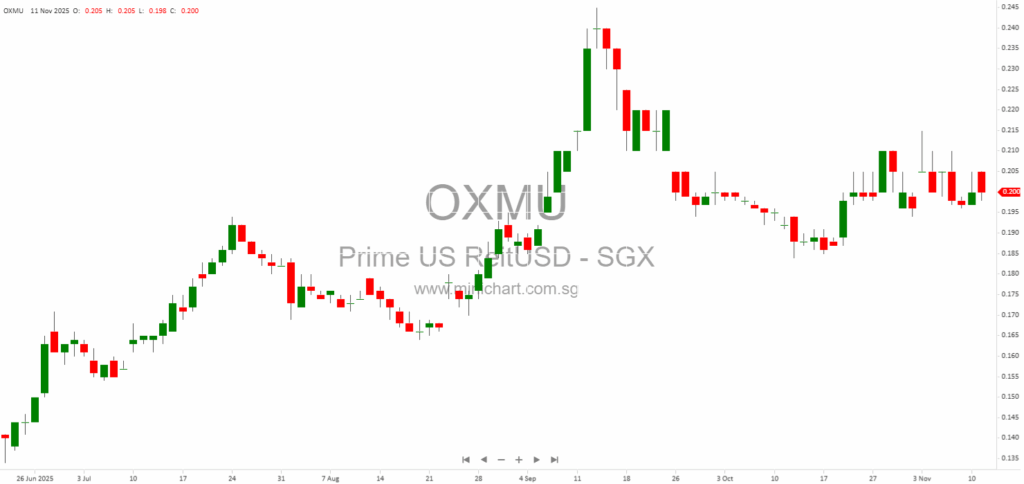

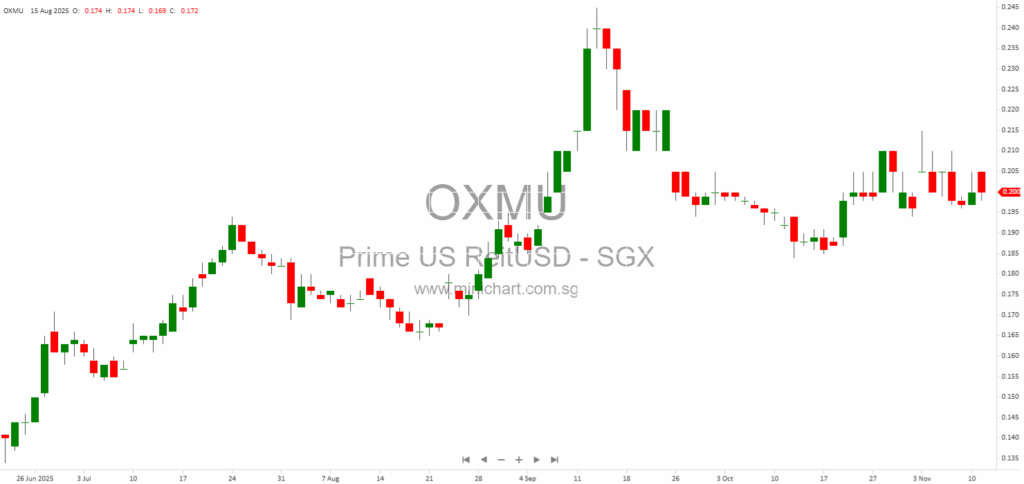

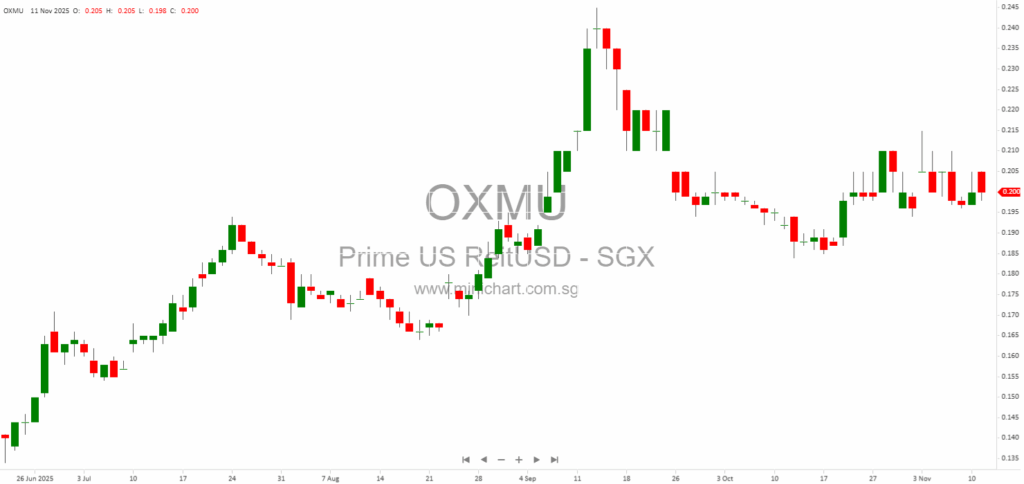

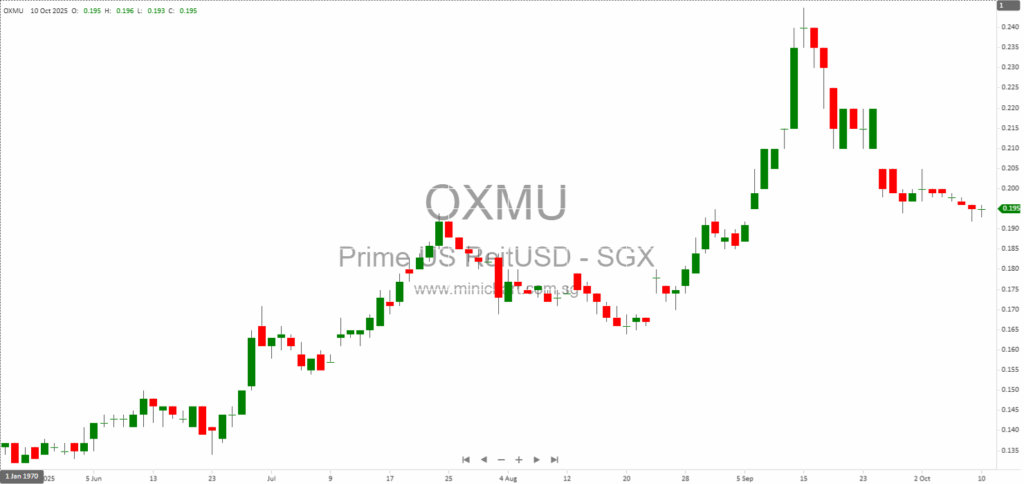

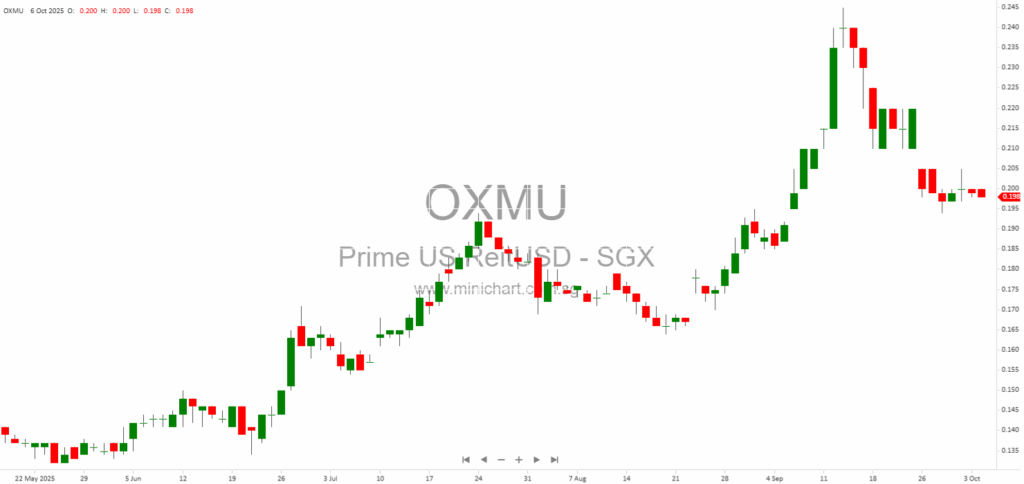

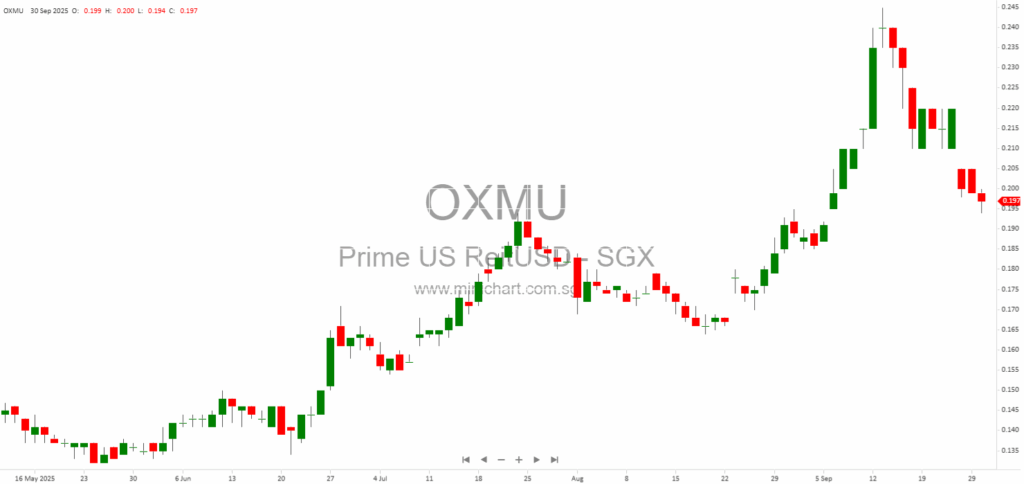

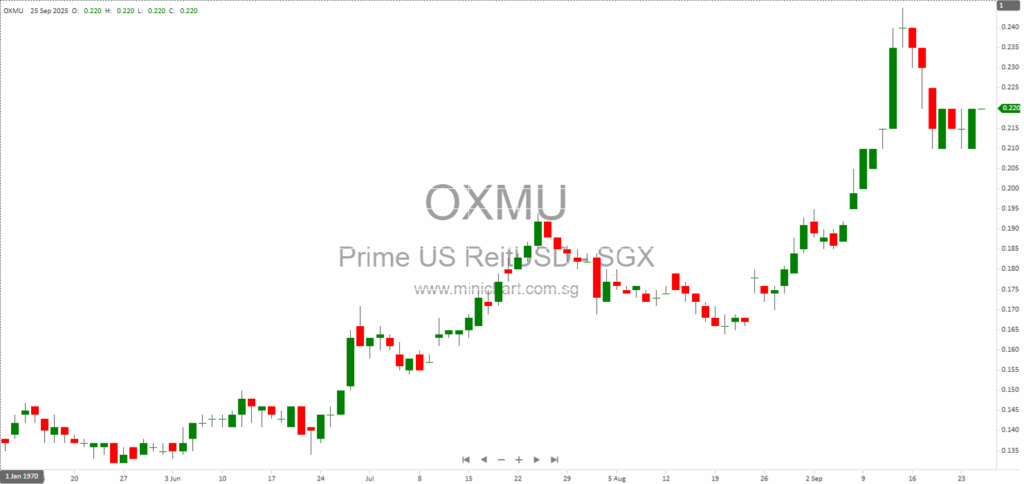

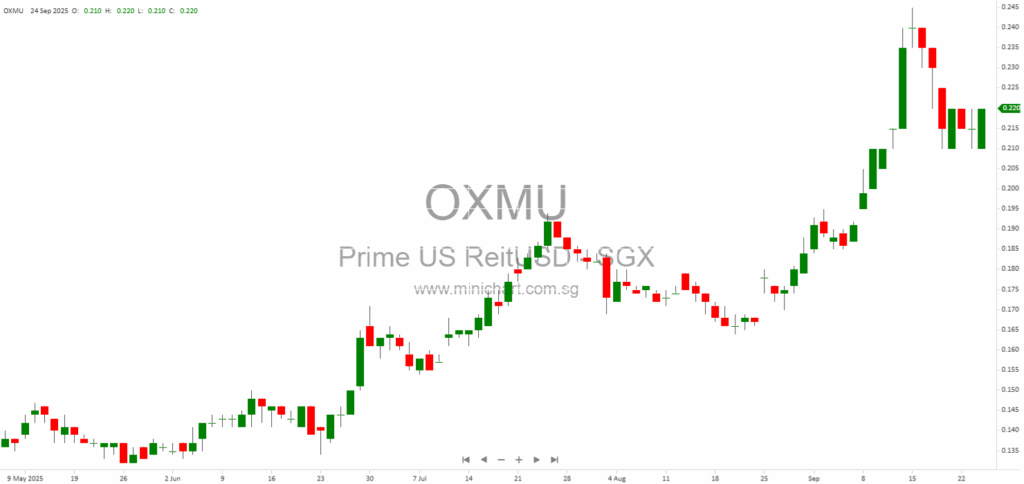

📈 Prime US REIT Historical Chart

🧾 Recent Financial Statement Analysis

February 11, 2026

Prime US REIT FY2025 Financial Results: Recovery Gaining Momentum Prime US REIT (“PRIME”) has released its FY2025 and 4Q2025 results, demonstrating significant improvements in portfolio fundamentals, leasing activity, and financial stability. The report highlights a rebound in the U.S. office…

February 11, 2026

Prime US REIT: Detailed Update on Use of Private Placement Proceeds Prime US REIT Announces Detailed Update on Use of Private Placement Proceeds Prime US REIT Management Pte. Ltd., the manager of Prime US REIT, has released a comprehensive update…

February 11, 2026

Prime US REIT Announces Dissolution of Subsidiaries Following Asset Divestment Prime US REIT Management Pte. Ltd., manager of Prime US REIT, has announced the dissolution of two subsidiaries following the divestment of a key asset, One Town Center. This update…

November 11, 2025

Prime US REIT Announces Major Distribution Policy Hike and Positive Leasing Momentum Prime US REIT Announces Major Distribution Policy Hike, Robust Leasing Activity, and U.S. Office Market Recovery Key Business and Operational Updates for 3Q2025 Prime US REIT (SGX: OXMU)…

November 11, 2025

Prime US REIT 3Q2025 Investor Report – Key Developments and Strategic Updates Prime US REIT 3Q2025 – Major Turnaround, Dividend Surge & Strategic Moves Signal Potential Upside Summary of Key Points Leasing momentum has significantly improved in 2025 Distributable income…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: OXMU, Prime US REIT

February 11, 2026

Prime US REIT FY2025 Financial Results: Recovery Gaining Momentum Prime US REIT (“PRIME”) has released its FY2025 and 4Q2025 results, demonstrating significant improvements in portfolio fundamentals, leasing activity, and financial stability. The report highlights a rebound in the U.S. office…

February 11, 2026

Prime US REIT: Detailed Update on Use of Private Placement Proceeds Prime US REIT Announces Detailed Update on Use of Private Placement Proceeds Prime US REIT Management Pte. Ltd., the manager of Prime US REIT, has released a comprehensive update…

February 11, 2026

Prime US REIT Announces Dissolution of Subsidiaries Following Asset Divestment Prime US REIT Management Pte. Ltd., manager of Prime US REIT, has announced the dissolution of two subsidiaries following the divestment of a key asset, One Town Center. This update…

November 11, 2025

Prime US REIT Announces Major Distribution Policy Hike and Positive Leasing Momentum Prime US REIT Announces Major Distribution Policy Hike, Robust Leasing Activity, and U.S. Office Market Recovery Key Business and Operational Updates for 3Q2025 Prime US REIT (SGX: OXMU)…

November 11, 2025

Prime US REIT 3Q2025 Investor Report – Key Developments and Strategic Updates Prime US REIT 3Q2025 – Major Turnaround, Dividend Surge & Strategic Moves Signal Potential Upside Summary of Key Points Leasing momentum has significantly improved in 2025 Distributable income…

October 11, 2025

Prime US REIT Deploys \$25 Million Placement Proceeds – What Investors Must Know About Debt Repayment & Future Utilisation Prime US REIT Deploys \$25 Million Placement Proceeds – What Investors Must Know About Debt Repayment & Future Utilisation Summary of…

October 6, 2025

Prime US REIT Surges With Major Private Placement and Distribution Policy Shift: What Investors Need to Know Prime US REIT Surges With Major Private Placement and Distribution Policy Shift: What Investors Need to Know Key Highlights of the Announcement Prime…

September 30, 2025

Prime US REIT Secures SGX Approval for Major Private Placement: What Investors Must Know Prime US REIT Secures SGX Approval for Major Private Placement: What Investors Must Know Key Points from the Announcement Prime US REIT has received approval in-principle…

September 26, 2025

Prime US REIT Locks In US\$25 Million Through Private Placement: What Investors Must Know About the Deep Discount, New Units, and Distribution Impacts Prime US REIT Locks In US\$25 Million Through Private Placement: What Investors Must Know About the Deep…

September 25, 2025

Prime US REIT Surges on Return-to-Office Momentum, Occupancy Gains, and Higher Payouts – Is a Turnaround Underway? Prime US REIT Surges on Return-to-Office Momentum, Occupancy Gains, and Higher Payouts – Is a Turnaround Underway? Key Highlights from the Latest Corporate…