📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

4.19%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-02-23

💰 Dividend History

Current year to date yield:

10.51%

📅 SGX Earnings Announcements for S61

SBS Transit Ltd (S61)

Market: SGX |

Currency: SGD

Address: 91 Sengkang East Avenue

SBS Transit Ltd provides bus and rail public transportation services, and consultancy services relating to land transport in Singapore. It operates through Public Transport Services and Other Commercial Services segments. The company operates MRT Line, an automatic underground heavy metro system; Downtown Line; and Sengkang and Punggol light rail transit systems. It also offers advertisement on the buses and trains; wheelchair accessible services; and road show and shop space for rent at bus interchanges and rail stations. It operates 200 bus services with a fleet of 3,329 buses. SBS Transit Ltd was formerly known as Singapore Bus Services Limited and changed its name to SBS Transit Ltd in November 2001. The company was founded in 1973 and is based in Singapore. SBS Transit Ltd operates as a subsidiary of ComfortDelGro Corporation Limited.

Show more

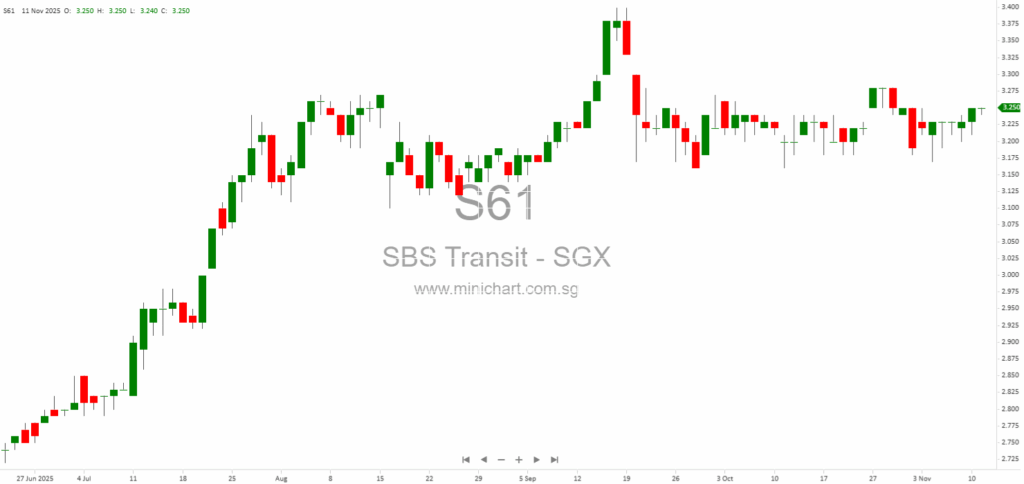

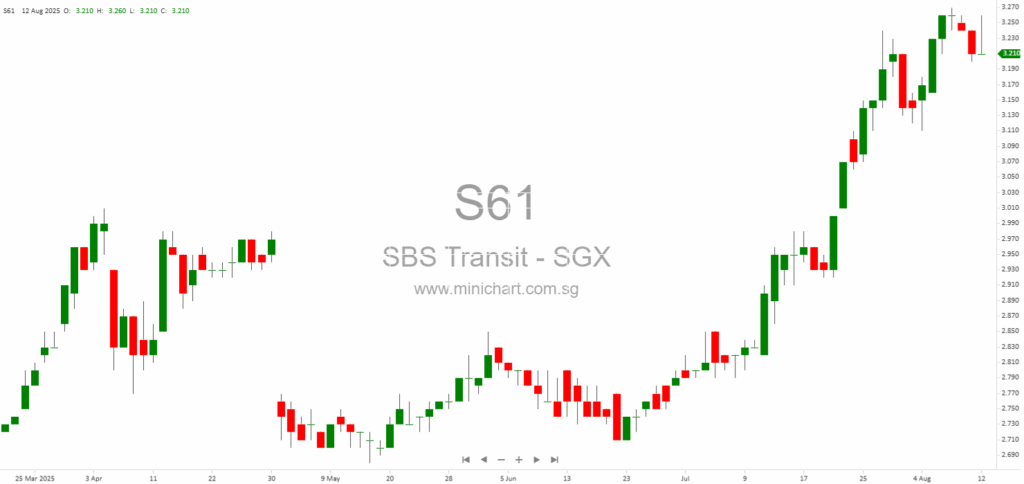

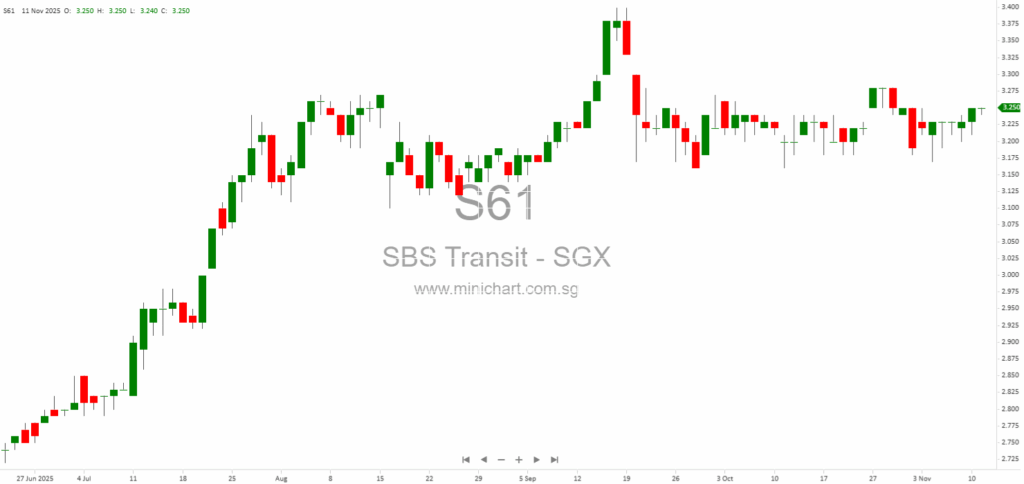

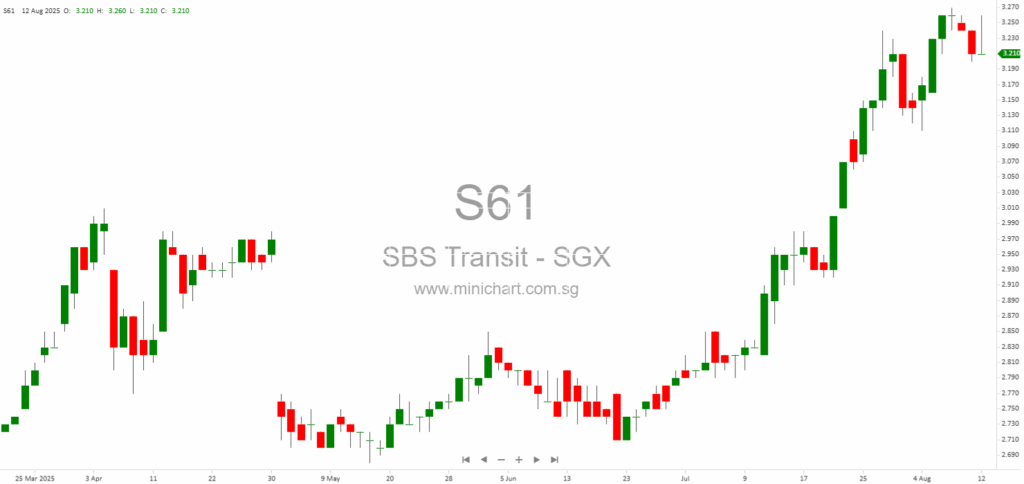

📈 SBS Transit Ltd Historical Chart

🧾 Recent Financial Statement Analysis

November 11, 2025

SBS Transit 3Q 2025 Business Update: Key Financial and Operational Highlights SBS Transit 3Q 2025 Business Update: Key Financial and Operational Highlights Overview SBS Transit Ltd has released its business and financial update for the third quarter (3Q) of 2025,…

August 12, 2025

SBS Transit Ltd: 1H2025 Financial Results Analysis SBS Transit has released its unaudited financial results for the half-year ended 30 June 2025. The report highlights a challenging operating environment due to the loss of a key bus package, but also…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: S61, SBS Transit Ltd, SBS Transit, SBUS SP, SBS TRANSIT LTD, SBS TRANSIT

November 11, 2025

SBS Transit 3Q 2025 Business Update: Key Financial and Operational Highlights SBS Transit 3Q 2025 Business Update: Key Financial and Operational Highlights Overview SBS Transit Ltd has released its business and financial update for the third quarter (3Q) of 2025,…

August 12, 2025

SBS Transit Ltd: 1H2025 Financial Results Analysis SBS Transit has released its unaudited financial results for the half-year ended 30 June 2025. The report highlights a challenging operating environment due to the loss of a key bus package, but also…

September 2, 2024

Sembcorp Industries Ltd (SCI SP), SBS Transit Ltd (SBUS SP) 🏗️ Sembcorp Industries Ltd (SCI SP) - Breaking Out of a Downtrend with Upside Potential Recommendation: Accumulate (Technical Buy) Target Price: S$5.25, S$5.55 Stop Loss: Below S$4.65 Date of Recommendation:…