📊 Statistics

- Analyst 1 Year Price Target:

$4.02

- Upside/Downside from Analyst Target:

15.04%

- Broker Call:

5

- Dividend Minimum 3 Year Yield:

2.79%

- EPS Growth Range (1Y):

25-50%

- Net Income Growth Range (1Y):

25-50%

- Revenue Growth Range (1Y):

10-25%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

2.79%

📅 SGX Earnings Announcements for S59

SIA Engineering Company Limited (S59)

Market: SGX |

Currency: SGD

Address: 31 Airline Road

SIA Engineering Company Limited, together with its subsidiaries, engages in the provision of maintenance, repair, and overhaul (MRO) services in Singapore, Philippines, Japan, Malaysia, Cambodia, and the United States of America. It operates through Airframe and Line Maintenance; and Engine and Component segments. The Airframe and Line Maintenance segment offers airframe maintenance, including scheduled routine maintenance and overhaul, specialized and non-routine maintenance, and modification, and refurbishment services; line maintenance that provides aircraft certification, and technical and non-technical ground handling services, such as push-back and towing, as well as aircraft ground support equipment and rectification work; and inventory technical management which provide fleet technical management and inventory technical management services comprising engineering and MRO solutions. The Engine and Component segment provides component overhaul, and engine repair and overhaul services. It also offers repair and overhaul services for hydro-mechanical equipment for Boeing and Airbus aircraft; turnkey solutions for aircraft interior modifications; and aircraft maintenance services that consist of technical and non-technical handling at the airport. The company was incorporated in 1982 and is based in Singapore. SIA Engineering Company Limited operates as a subsidiary of Singapore Airlines Limited.

Show more

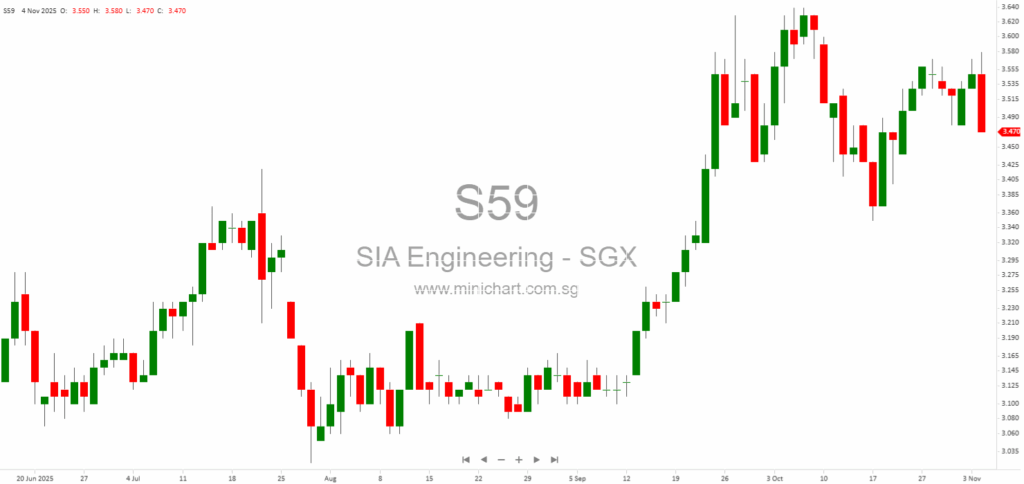

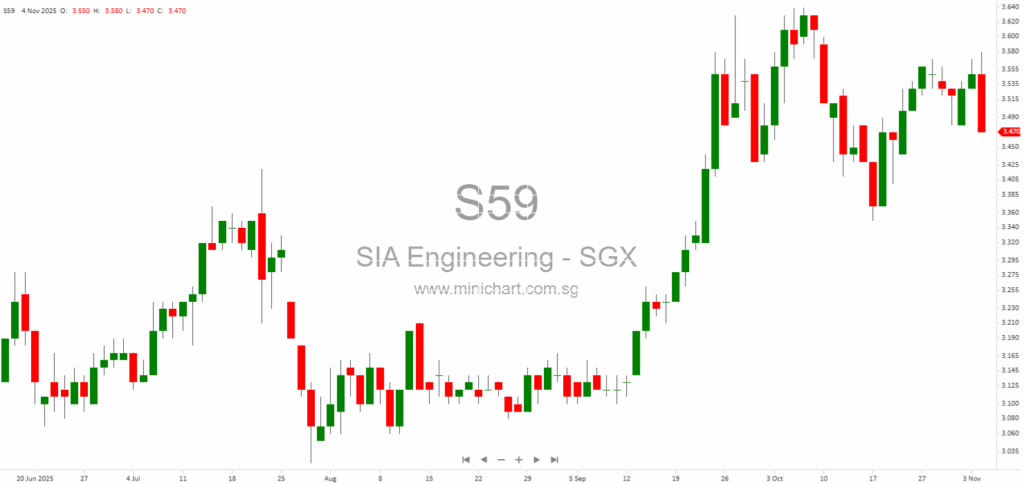

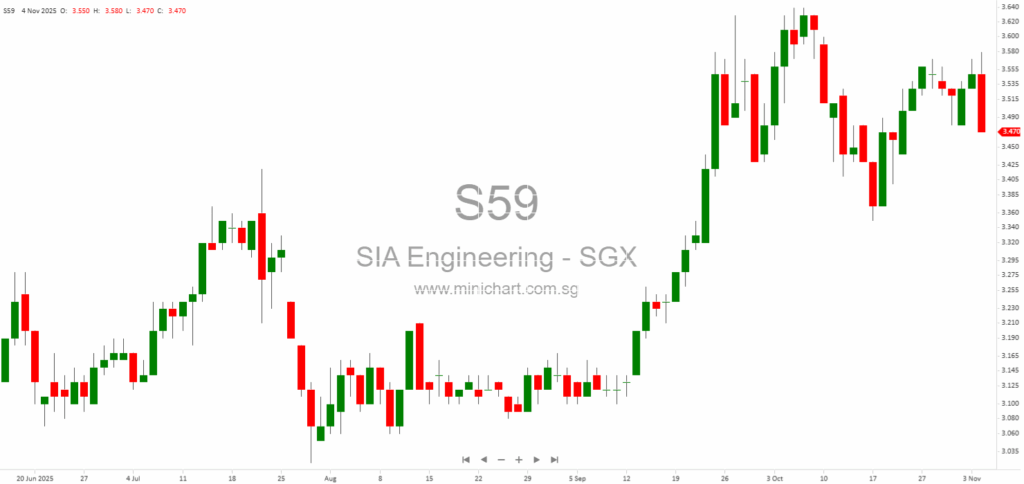

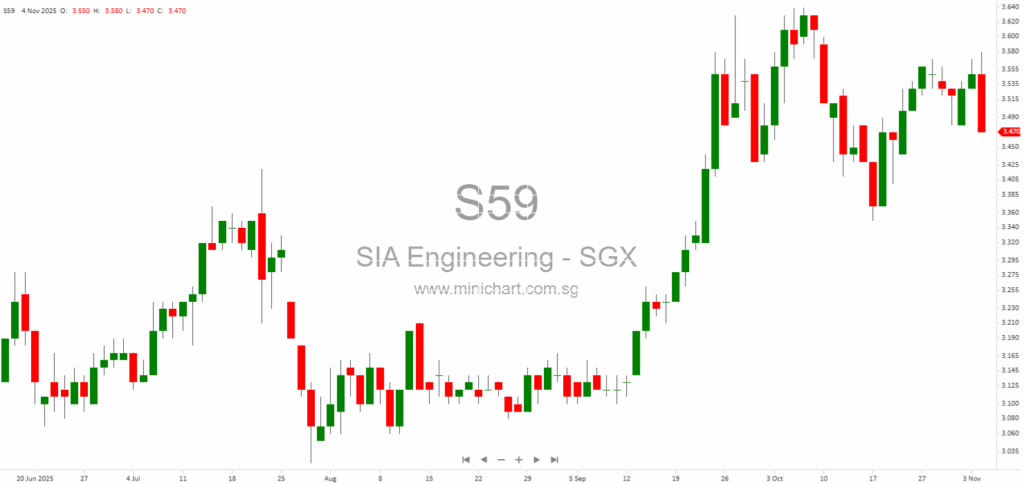

📈 SIA Engineering Company Limited Historical Chart

🧾 Recent Financial Statement Analysis

December 10, 2025

SIA Engineering Company Appoints Liquidators for Dormant Subsidiary SIA Engineering Company Appoints Liquidators for Dormant Subsidiary Key Highlights SIA Engineering Company Limited (SIAEC) has initiated a member’s voluntary liquidation for its dormant, wholly-owned subsidiary, NexGen Network (2) Holding Pte. Ltd.…

November 4, 2025

SIA Engineering Company Limited: H1 FY2025/26 Financial Analysis SIA Engineering Company Limited ("SIAEC") has released its condensed interim financial statements for the half year ended 30 September 2025. The results highlight strong operational performance, robust demand for maintenance, repair and…

November 4, 2025

1H FY2025/26 Financial Analysis: Bolstering Resilience and Investing in Growth The latest half-yearly report for 1H FY2025/26 reveals robust performance for the group, supported by healthy demand in maintenance, repair, and overhaul (MRO) services. This article provides a detailed financial…

November 4, 2025

NIL Disclaimer: This article does not constitute investment advice. Investors should consult with a qualified financial advisor before making any investment decisions. View SIA Engineering Historical chart here

October 15, 2025

SIA Engineering Company Limited: Upcoming Half-Year FY2025/26 Results Announcement SIA Engineering Company Limited (SIAEC), a leading provider of aircraft maintenance, repair, and overhaul (MRO) services, has announced that it will release its financial results for the half-year ended 30 September…

October 29, 2024

SIA Engineering Company Limited will be announcing its financial results for the half-year ended 30 September 2024 on Tuesday, 5 November 2024, after trading hours of the Singapore Exchange Securities Trading Limited. The financial results will also be made available…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: S59, SIA Engineering Company Limited, SIA Engineering, SIE SP, SIA ENGINEERING CO LTD, SIA ENGINEERING CO

December 10, 2025

SIA Engineering Company Appoints Liquidators for Dormant Subsidiary SIA Engineering Company Appoints Liquidators for Dormant Subsidiary Key Highlights SIA Engineering Company Limited (SIAEC) has initiated a member’s voluntary liquidation for its dormant, wholly-owned subsidiary, NexGen Network (2) Holding Pte. Ltd.…

November 7, 2025

Broker Name: CGS International Date of Report: November 7, 2025 Excerpt from CGS International report. Report Summary: SIA Engineering Co Ltd (SIE SP) is showing a strong and sturdy bullish trend, with technical indicators supporting continued uptrend momentum. The recommended…

November 7, 2025

Broker: CGS International Date of Report: November 6, 2025 Excerpt from CGS International report. Report Summary SIA Engineering (SIE) posted a 21% year-on-year increase in 1HFY26 core net profit to S\$83.4m, driven by higher contract rates with Singapore Airlines and…

November 7, 2025

Broker Name: OCBC Investment Research Date of Report: 6 November 2025 Excerpt from OCBC Investment Research report. SIA Engineering Company (SIAEC) delivered strong 1HFY26 results with revenue and PATMI growing by 26.5% and 21.1% year-on-year, respectively, driven by robust MRO…

November 5, 2025

Broker Name: Lim & Tan Securities Date of Report: 5 November 2025 Excerpt from Lim & Tan Securities report. Report Summary Singapore’s FSSTI index is up 16.8% YTD; U.S. tech stocks saw profit-taking with 1-2% declines overnight. SIA Engineering reported…

November 4, 2025

SIA Engineering Company Limited: H1 FY2025/26 Financial Analysis SIA Engineering Company Limited ("SIAEC") has released its condensed interim financial statements for the half year ended 30 September 2025. The results highlight strong operational performance, robust demand for maintenance, repair and…

November 4, 2025

1H FY2025/26 Financial Analysis: Bolstering Resilience and Investing in Growth The latest half-yearly report for 1H FY2025/26 reveals robust performance for the group, supported by healthy demand in maintenance, repair, and overhaul (MRO) services. This article provides a detailed financial…

November 4, 2025

NIL Disclaimer: This article does not constitute investment advice. Investors should consult with a qualified financial advisor before making any investment decisions. View SIA Engineering Historical chart here

October 15, 2025

SIA Engineering Company Limited: Upcoming Half-Year FY2025/26 Results Announcement SIA Engineering Company Limited (SIAEC), a leading provider of aircraft maintenance, repair, and overhaul (MRO) services, has announced that it will release its financial results for the half-year ended 30 September…

July 23, 2025

CGS International Securities July 23, 2025 SIA Engineering’s Stock Rally Pauses: Upgraded Earnings, But Valuation Stretched After 54% Surge Introduction: SIA Engineering’s Soaring Share Price Prompts Downgrade SIA Engineering (SIE), a key player in Singapore’s aviation maintenance, repair, and overhaul…

May 15, 2025

CGS International May 14, 2025 SIA Engineering: Building Capacity for Long-Term Growth Key Takeaways from SIA Engineering's FY3/25 Performance FY3/25 core net profit reached S\$140.2m, slightly below forecast due to interest income and tax deviations [[1]]. Underlying operating profit and…

May 14, 2025

CGS International May 14, 2025 SIA Engineering: Building Capacity for Long-Term Growth SIA Engineering (SIE) FY3/25 Core Net Profit Analysis FY3/25 core net profit of S\$140.2m was 2.6% below forecast, mainly due to unfavorable deviations in interest income and tax…

October 29, 2024

SIA Engineering Company Limited will be announcing its financial results for the half-year ended 30 September 2024 on Tuesday, 5 November 2024, after trading hours of the Singapore Exchange Securities Trading Limited. The financial results will also be made available…