📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

-

- EPS Growth Range (1Y):

-

- Net Income Growth Range (1Y):

-

- Revenue Growth Range (1Y):

-

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

1.08%

Amount: $0.000000

Yield: -

Pay Date: 2024-11-01

Details:

Ratio: 4:100

📅 SGX Earnings Announcements for J91U.SI

| Date of Broadcast |

Title |

Financial Year Ended |

ESR-REIT (J91U.SI)

Market: SGX |

Currency: SGD

Address: 5 Temasek Boulevard

ESR-LOGOS REIT is a leading New Economy and future-ready Asia Pacific S-REIT. Listed on the Singapore Exchange Securities Trading Limited since 25 July 2006, ESR-LOGOS REIT invests in quality income-producing industrial properties in key gateway markets. As at 31 December 2023, ESR-LOGOS REIT holds interests in a diversified portfolio of logistics properties, high-specifications industrial properties, business parks and general industrial properties with total assets of approximately S$5.1 billion. Its portfolio comprises 72 properties (excluding 48 Pandan Road held through a joint venture) located across the developed markets of Singapore (52 assets), Australia (19 assets) and Japan (1 asset), with a total gross floor area of approximately 2.1 million sqm, as well as investments in three property funds in Australia. ESR-LOGOS REIT is also a constituent of the FTSE EPRA Nareit Global Real Estate Index. ESR-LOGOS REIT is managed by ESR-LOGOS Funds Management (S) Limited (the ?Manager?) and sponsored by ESR Group Limited (?ESR?). The Manager is owned by ESR (99.0%) and Shanghai Summit Pte. Ltd. (1.0%), respectively.

Show more

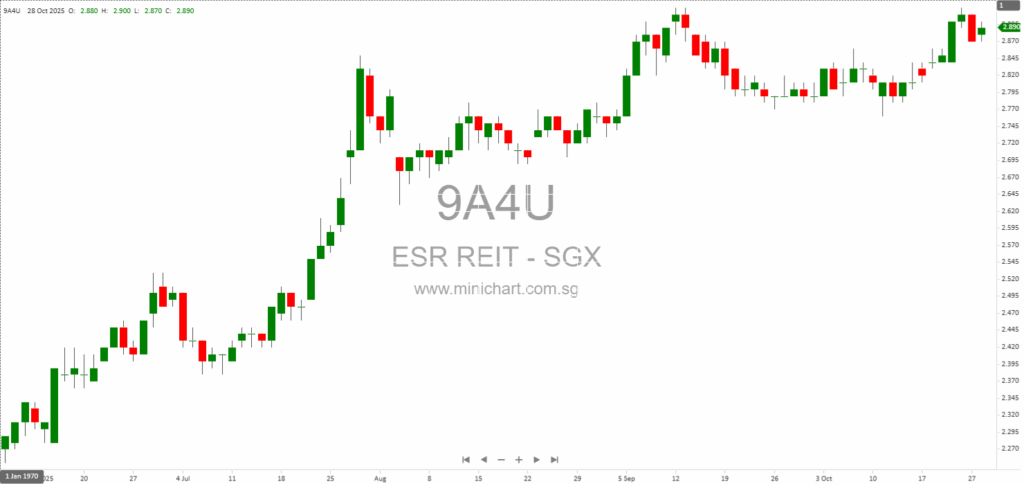

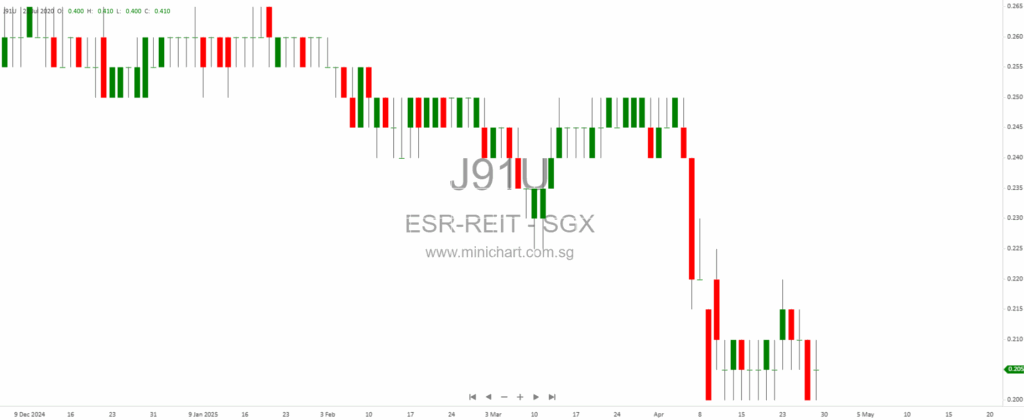

📈 ESR-REIT Historical Chart

🧾 Recent Financial Statement Analysis

February 3, 2026

ESR-REIT FY2025 Financial Results: Steady Growth, Portfolio Rejuvenation, and Prudent Capital Management ESR-REIT, a leading Singapore-focused industrial real estate investment trust, delivered its FY2025 results with clear signs of operational improvement, portfolio optimization, and enhanced capital management. The REIT continues…

January 31, 2026

ESR-REIT Announces S\$101 Million Divestment of Hotel Strata Lot at ESR BizPark @ Changi ESR-REIT Divests Hotel Strata Lot at ESR BizPark @ Changi for S\$101 Million Key Highlights and Strategic Implications for Investors ESR-REIT Management (S) Limited has announced…

January 31, 2026

ESR-REIT Divests Hotel Strata Lot at 2 Changi Business Park Avenue 1 for S\$101 Million ESR-REIT Announces Strategic S\$101 Million Divestment of Hotel Strata Lot at 2 Changi Business Park Avenue 1 Key Highlights Divestment of Non-Core Asset: ESR-REIT is…

January 10, 2026

ESR-REIT: Financial Results Announcement and Business Update ESR-REIT, a leading Asia Pacific industrial real estate investment trust listed on the Singapore Exchange, has announced the release date for its unaudited financial results for the half year and full year ended…

December 14, 2025

ESR-REIT Announces S\$338.1 Million Divestment of Eight Non-Core Singapore Assets ESR-REIT Announces S\$338.1 Million Divestment of Eight Non-Core Singapore Assets Major Portfolio Rejuvenation and Capital Recycling Initiative to Enhance Quality and Financial Flexibility Singapore, 15 December 2025 – ESR-REIT Management…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: J91U.SI, ESR-REIT

February 5, 2026

Broker Name: CGS International Date of Report: February 5, 2026 Excerpt from CGS International report. Report Summary ESR-REIT delivered FY25 DPU growth of 3.4% year-on-year, supported by acquisitions and asset enhancement initiatives, with stable occupancy and strong portfolio reversion led…

February 3, 2026

ESR-REIT FY2025 Financial Results: Steady Growth, Portfolio Rejuvenation, and Prudent Capital Management ESR-REIT, a leading Singapore-focused industrial real estate investment trust, delivered its FY2025 results with clear signs of operational improvement, portfolio optimization, and enhanced capital management. The REIT continues…

January 31, 2026

ESR-REIT Announces S\$101 Million Divestment of Hotel Strata Lot at ESR BizPark @ Changi ESR-REIT Divests Hotel Strata Lot at ESR BizPark @ Changi for S\$101 Million Key Highlights and Strategic Implications for Investors ESR-REIT Management (S) Limited has announced…

January 31, 2026

ESR-REIT Divests Hotel Strata Lot at 2 Changi Business Park Avenue 1 for S\$101 Million ESR-REIT Announces Strategic S\$101 Million Divestment of Hotel Strata Lot at 2 Changi Business Park Avenue 1 Key Highlights Divestment of Non-Core Asset: ESR-REIT is…

January 10, 2026

ESR-REIT: Financial Results Announcement and Business Update ESR-REIT, a leading Asia Pacific industrial real estate investment trust listed on the Singapore Exchange, has announced the release date for its unaudited financial results for the half year and full year ended…

December 14, 2025

ESR-REIT Announces S\$338.1 Million Divestment of Eight Non-Core Singapore Assets ESR-REIT Announces S\$338.1 Million Divestment of Eight Non-Core Singapore Assets Major Portfolio Rejuvenation and Capital Recycling Initiative to Enhance Quality and Financial Flexibility Singapore, 15 December 2025 – ESR-REIT Management…

December 14, 2025

ESR-REIT Announces S\$338.1 Million Divestment of Eight Singapore Industrial Properties Singapore, 15 December 2025 – ESR-REIT Management (S) Limited (“the Manager”), manager of ESR-REIT, has announced a significant portfolio divestment involving eight industrial properties in Singapore. The transaction, executed through…

November 3, 2025

Broker: CGS International Securities Date of Report: October 30, 2025 Excerpt from CGS International Securities report ESR-REIT reported 9M25 distributable income of S\$134.6m, in line with forecasts, supported by acquisitions, positive rental reversions, and lower utilities costs. Portfolio occupancy dipped…

October 29, 2025

ESR-REIT Delivers Robust 3Q2025 Earnings Surge Amid Strategic Portfolio Moves and Lower Debt Costs ESR-REIT Delivers Robust 3Q2025 Earnings Surge Amid Strategic Portfolio Moves and Lower Debt Costs Key Highlights from ESR-REIT’s 3Q2025 Interim Business Update ESR-REIT has released its…

September 7, 2025

ESR-REIT Focuses on Stability After Years of Active Rejuvenation SGX:J91U.SI:ESR-REIT After two years of heavy portfolio rejuvenation, acquisitions, and equity fund raising, ESR-REIT is pivoting to stability. CEO Adrian Chui said the industrial REIT will focus on earnings from core…