📊 Statistics

- Analyst 1 Year Price Target:

$1.40

- Upside/Downside from Analyst Target:

2.71%

- Broker Call:

9

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

0.00%

Amount: $0.000000

Yield: -

Pay Date: 2026-01-19

Details:

Ratio: 4:1

📅 SGX Earnings Announcements for 558

UMS Integration Limited (558)

Market: SGX |

Currency: SGD

Address: 23 Changi North Crescent

UMS Integration Limited, an investment holding company, manufactures and markets precision machining components, and provides electromechanical assembly and final testing services. It operates in three segments: Semiconductor, Aerospace, and Others. The Semiconductor segment offers precision machining components and equipment modules for semiconductor equipment manufacturers. The Aerospace segment provides precision machining services for aerospace, oil and gas industries, and other general engineering and machinery works. The Others segment provides water disinfection systems shipment services, as well as trades in nonferrous metal alloys and cutting tools. It also offers metal finishing services, such as electroless and selective nickel, anodizing, plating, e-polish, chemical cleaning, and parts refurbishment; and system integration, refurbishment, prototyping, and vendor managed inventory services, as well as anodizing services. The company operates in Singapore, Malaysia, Taiwan, the United States, South Korea, the People's Republic of China, and internationally. The company was formerly known as UMS Holdings Limited and changed its name to UMS Integration Limited in September 2024. UMS Holdings Limited was incorporated in 2001 and is headquartered in Singapore. UMS Integration Limited operates as a subsidiary of Catcher Technology Co., Ltd.

Show more

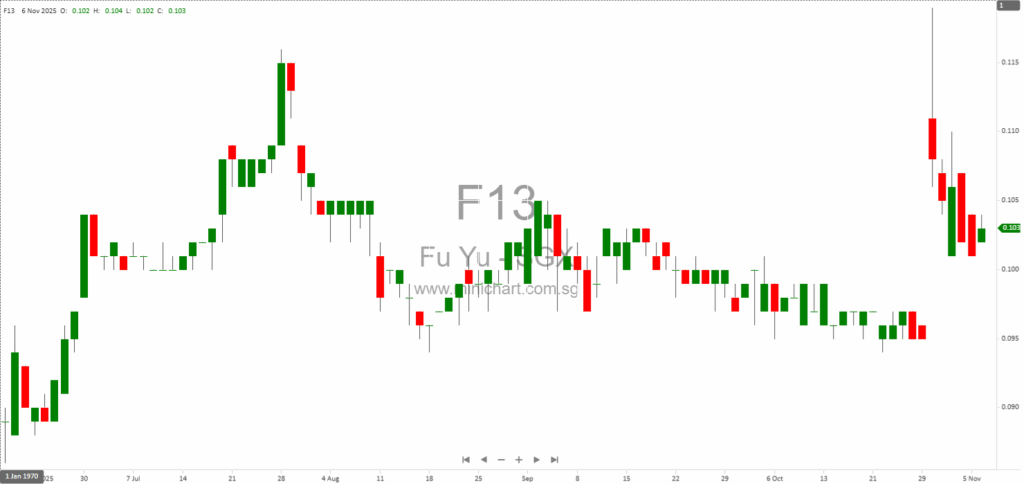

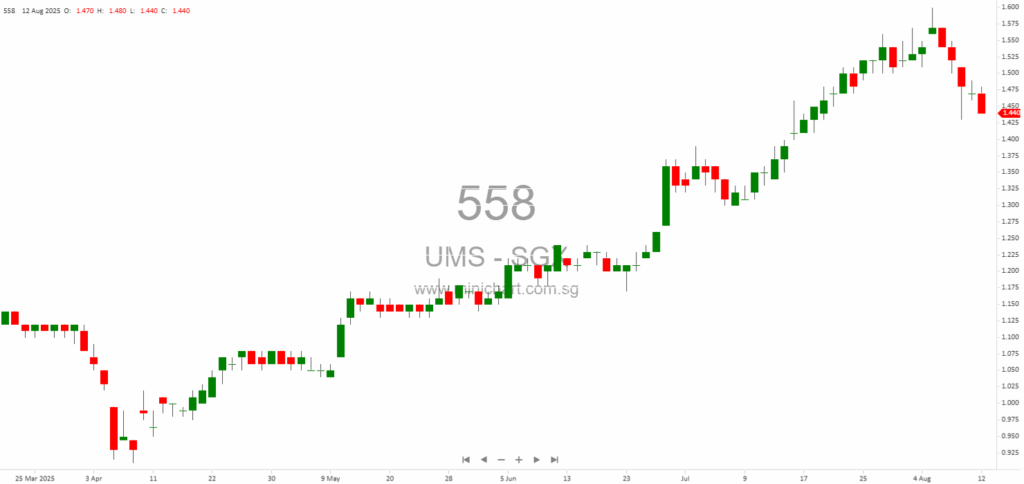

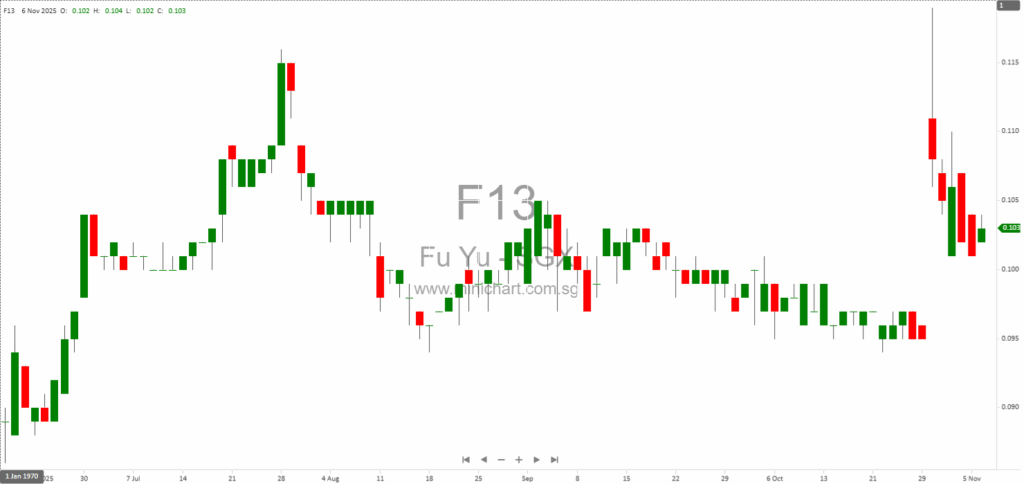

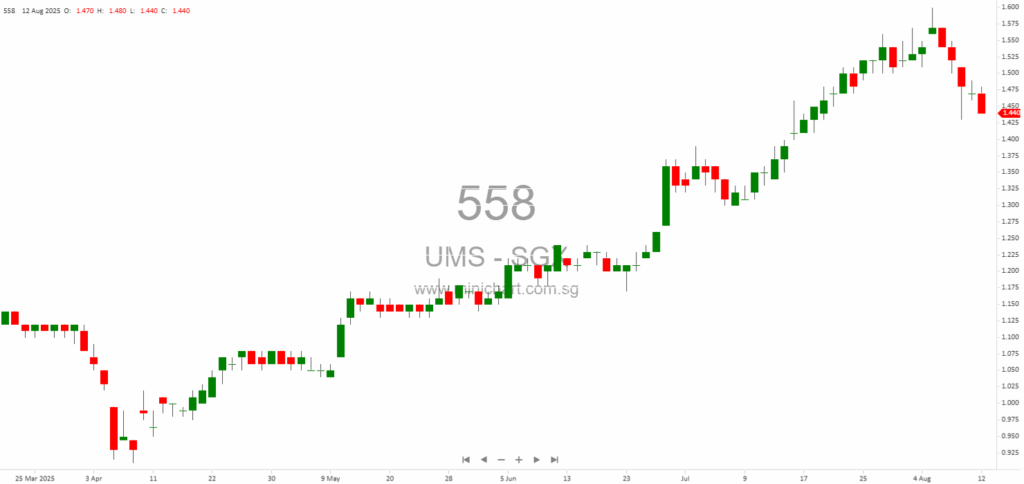

📈 UMS Integration Limited Historical Chart

🧾 Recent Financial Statement Analysis

November 7, 2025

UMS Integration Limited Financial Update: 9MFY2025 UMS Integration Limited Delivers Robust 9MFY2025 Results Amid Global Industry Tailwinds Key Highlights for Investors Net Attributable Profit Up 4%: UMS reported a net attributable profit of S\$30.5 million for the first nine months…

November 7, 2025

Financial Performance in Detail Revenue Analysis Q3 2025: Group revenue fell 9% year-on-year to S\$59.3 million, mainly due to lower sales in the Semiconductor (-8%) and Aerospace (-16%) segments. However, the 'Others' segment rose 5%. Singapore and USA sales dropped…

November 6, 2025

Fu Yu Corporation Limited: Detailed Update on Termination of Group CEO and Corporate Governance Actions Fu Yu Corporation Limited Issues Detailed Update on Termination of Group CEO and Corporate Governance Measures Key Highlights for Investors Termination of Group CEO with…

August 12, 2025

UMS Integration Limited: 2Q & 1H2025 Financial Performance and Outlook UMS Integration Limited, a leading provider in the semiconductor and precision engineering space, reported robust results for the second quarter and first half of 2025. The Group continues to benefit…

November 8, 2024

UMS Integration Limited Announces Third Interim Dividend: Key Details for Shareholders UMS Integration Limited Announces Third Interim Dividend: Key Details for Shareholders UMS Integration Limited (formerly known as UMS Holdings Limited) has made an important announcement regarding its third interim…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: 558, UMS Integration Limited, UMS, UMSH SP, UMS INTEGRATION LTD, UMS INTEGRATION

February 10, 2026

DBS, February 2025 Excerpt from DBS report. Report Summary Singapore’s technology sector is supported by an upgraded GDP growth forecast and strong fixed asset investment, particularly in electronics and semiconductors, positioning firms like UMS, Frencken, and AEM for multi-year growth…

January 22, 2026

Broker Name: CGS International Date of Report: January 22, 2026 Excerpt from CGS International report. The Singapore market remains dominant in Asia, with the MSCI Singapore Free Index showing resilience and potential for a bullish rally if it holds above…

November 7, 2025

UMS Integration Limited Financial Update: 9MFY2025 UMS Integration Limited Delivers Robust 9MFY2025 Results Amid Global Industry Tailwinds Key Highlights for Investors Net Attributable Profit Up 4%: UMS reported a net attributable profit of S\$30.5 million for the first nine months…

November 7, 2025

Financial Performance in Detail Revenue Analysis Q3 2025: Group revenue fell 9% year-on-year to S\$59.3 million, mainly due to lower sales in the Semiconductor (-8%) and Aerospace (-16%) segments. However, the 'Others' segment rose 5%. Singapore and USA sales dropped…

November 6, 2025

Fu Yu Corporation Limited: Detailed Update on Termination of Group CEO and Corporate Governance Actions Fu Yu Corporation Limited Issues Detailed Update on Termination of Group CEO and Corporate Governance Measures Key Highlights for Investors Termination of Group CEO with…

November 4, 2025

Broker Name: CGS International Date of Report: November 4, 2025 Excerpt from CGS International report. Report Summary UMS Integration Ltd shows a confirmed bullish continuation, supported by technical indicators such as a breakout from a bullish symmetrical triangle, strong Ichimoku…

October 14, 2025

Broker: CGS International Date of Report: October 13, 2025 Excerpt from CGS International report. Leverage is the main risk driver: The recent US market correction was triggered by an unwind of extreme leverage and crowded trades, particularly in tech and…

August 22, 2025

Broker: CGS International Date of Report: August 21, 2025 UMS Integration Ltd: Secondary Listing, Robust Growth Prospects, and Peer Comparison in the Semiconductor Sector Introduction: UMS Integration Ltd's Strategic Expansion and Outlook UMS Integration Ltd (UMS), a precision engineering powerhouse…

August 14, 2025

Broker: Maybank Research Pte Ltd Date of Report: August 13, 2025 UMS Integration: Strong 2H25 Outlook with New Product Wins and Dividend Potential Overview and Investment Thesis UMS Integration (UMSH SP/UMSINT MK) is positioned for a robust second half of…

August 12, 2025

UMS Integration Limited: 2Q & 1H2025 Financial Performance and Outlook UMS Integration Limited, a leading provider in the semiconductor and precision engineering space, reported robust results for the second quarter and first half of 2025. The Group continues to benefit…

July 22, 2025

Broker: Maybank Research Pte Ltd Date of Report: July 21, 2025 UMS Integration: Bursa Malaysia Listing Set to Unlock Valuation Upside and Fuel Growth Overview: UMS Integration Targets Higher Growth with Bursa Malaysia Listing UMS Integration (UMSH SP), a leader…

May 15, 2025

Maybank Research Pte Ltd May 13, 2025 UMS Integration (UMSH SP): Poised for QoQ Improvement – Maintain BUY Rating Investment Thesis: Improving Outlook Justifies BUY Recommendation UMS Integration's 1Q25 revenue demonstrated a 7% year-over-year increase, reaching SGD57.6 million, aligning with…

March 5, 2025

Singapore Retail Research: Comprehensive Analysis of Listed Companies Broker: CGS International Securities | Date: March 5, 2025 Market Overview In the evolving landscape of the global market, oil prices have been fluctuating amidst geopolitical tensions and trade considerations. As traders…

November 8, 2024

UMS Integration Limited Announces Third Interim Dividend: Key Details for Shareholders UMS Integration Limited Announces Third Interim Dividend: Key Details for Shareholders UMS Integration Limited (formerly known as UMS Holdings Limited) has made an important announcement regarding its third interim…