📊 Statistics

- Analyst 1 Year Price Target:

$1.03

- Upside/Downside from Analyst Target:

8.53%

- Broker Call:

10

- Dividend Minimum 3 Year Yield:

6.21%

- EPS Growth Range (1Y):

200-500%

- Net Income Growth Range (1Y):

200-500%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-07-29

💰 Dividend History

Current year to date yield:

3.67%

📅 SGX Earnings Announcements for K71U

Keppel REIT (K71U)

Market: SGX |

Currency: SGD

Address: 1 HarbourFront Avenue

Listed by way of an introduction on 28 April 2006, Keppel REIT is one of Asia's leading real estate investment trusts with a portfolio of prime commercial assets in Asia Pacific's key business districts. Keppel REIT's objective is to generate stable income and sustainable long-term total return for its Unitholders by owning and investing in a portfolio of quality income-producing commercial real estate and real estate-related assets in Asia Pacific. Keppel REIT has a portfolio value of over $9 billion, comprising properties in Singapore; the key Australian cities of Sydney, Melbourne and Perth; Seoul, South Korea; as well as Tokyo, Japan. Keppel REIT is managed by Keppel REIT Management Limited and sponsored by Keppel, a global asset manager and operator with strong expertise in sustainability-related solutions spanning the areas of infrastructure, real estate and connectivity.

Show more

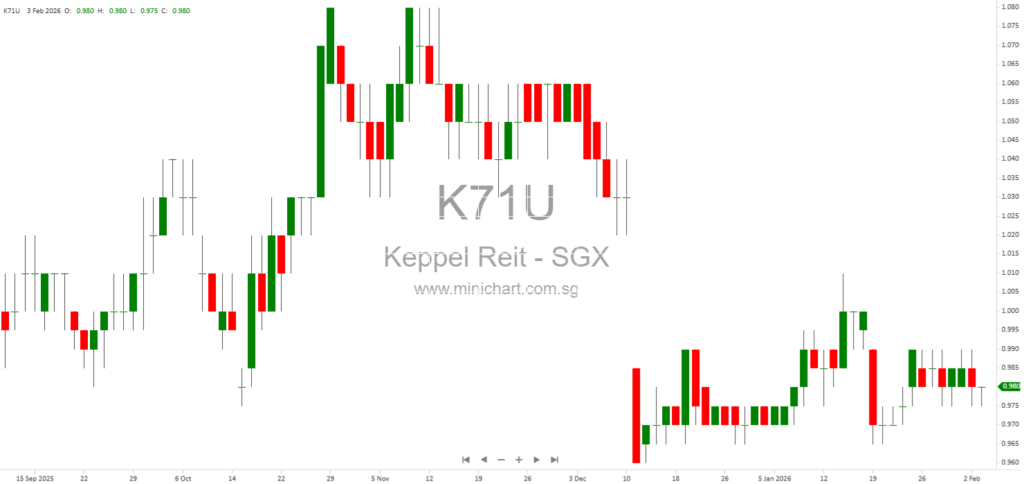

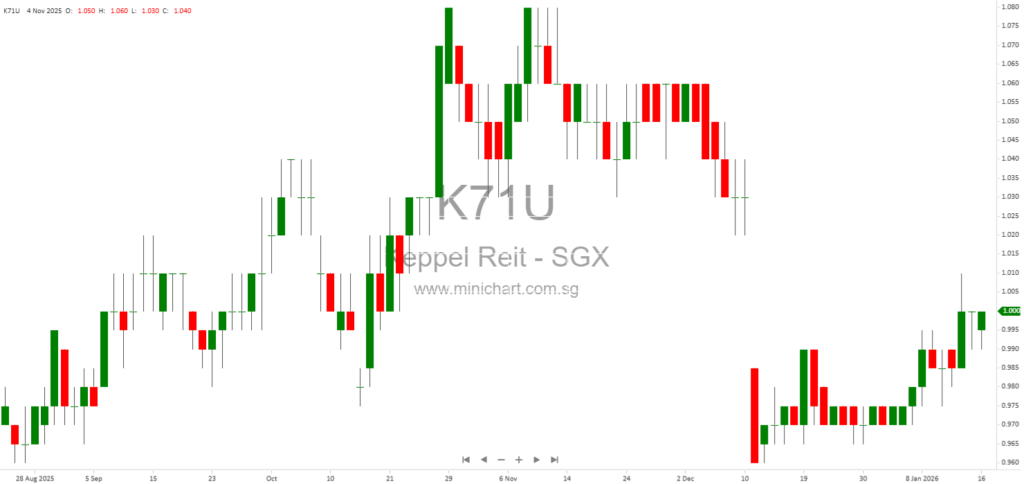

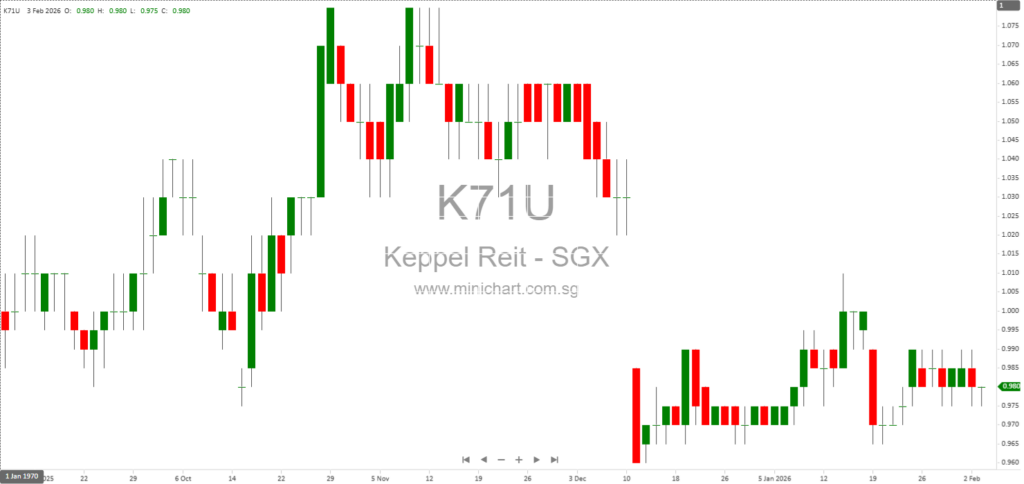

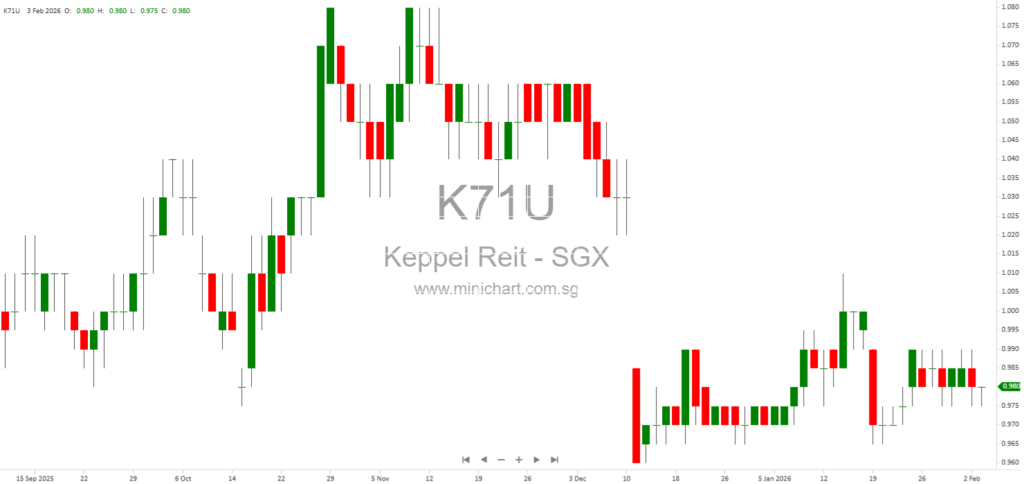

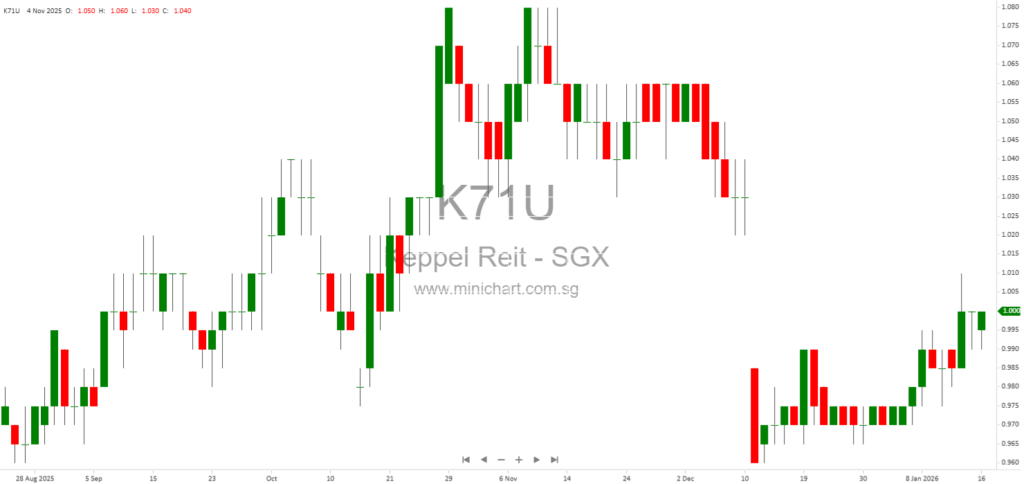

📈 Keppel REIT Historical Chart

🧾 Recent Financial Statement Analysis

February 4, 2026

Keppel Ltd. Proposes Special Dividend: Cash and Keppel REIT Units Distribution Keppel Ltd. Announces Proposed Special Dividend: Cash and Keppel REIT Units Distribution Summary of Key Points Special Dividend Proposal: Keppel Ltd. will reward shareholders with a proposed special dividend…

February 3, 2026

Keppel REIT Announces Acquisitions and Increased Stake in MBFC Tower 3 Keppel REIT Announces Strategic Acquisitions and Increased Stake in MBFC Tower 3 Key Highlights Establishment of a New Subsidiary in Australia: Keppel REIT has established Keppel REIT (Australia) Sub-Trust…

February 3, 2026

Keppel REIT FY 2025 Financial Results: Robust Asset Growth and Strategic Acquisitions Keppel REIT released its financial results for the second half and full year ended 31 December 2025, demonstrating a strong operating performance, strategic acquisitions, and continued portfolio optimization…

January 18, 2026

Key Details of the Preferential Offering Offering Structure: The preferential offering was pro-rata and non-renounceable, with eligible unitholders entitled to 23 new units for every 100 existing units held as at 5:00 p.m. on 22 December 2025. Issue Price: Each…

January 2, 2026

Keppel REIT Dialogue: Detailed Report on Acquisition of One-Third Interest in Marina Bay Financial Centre Tower 3 Keppel REIT’s Strategic Acquisition of Additional Interest in MBFC Tower 3: Key Takeaways for Investors Introduction Keppel REIT Management Limited recently conducted a…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: K71U, Keppel REIT

February 5, 2026

Broker Name: Maybank Research Pte Ltd Date of Report: February 5, 2026 Excerpt from Maybank Research Pte Ltd report. Report Summary: Keppel REIT delivered stable operational performance in FY25, with occupancy rising in both Singapore and Australia, and continued positive…

February 5, 2026

Broker Name: OCBC Group Research Date of Report: 4 February 2026 Excerpt from OCBC Group Research report. Report Summary Keppel REIT’s FY25 distribution per unit (DPU) fell 6.6% year-on-year, missing expectations, but the portfolio saw robust rental reversions of 11.5%…

February 5, 2026

Broker Name: OCBC Group Research Date of Report: 4 February 2026 Excerpt from OCBC Group Research report. Report Summary Keppel REIT (KREIT) reported a 6.6% year-on-year decline in FY25 distribution per unit (DPU) to 5.23 Singapore cents, missing expectations, but…

February 4, 2026

Keppel Ltd. Proposes Special Dividend: Cash and Keppel REIT Units Distribution Keppel Ltd. Announces Proposed Special Dividend: Cash and Keppel REIT Units Distribution Summary of Key Points Special Dividend Proposal: Keppel Ltd. will reward shareholders with a proposed special dividend…

February 3, 2026

Keppel REIT Announces Acquisitions and Increased Stake in MBFC Tower 3 Keppel REIT Announces Strategic Acquisitions and Increased Stake in MBFC Tower 3 Key Highlights Establishment of a New Subsidiary in Australia: Keppel REIT has established Keppel REIT (Australia) Sub-Trust…

February 3, 2026

Keppel REIT FY 2025 Financial Results: Robust Asset Growth and Strategic Acquisitions Keppel REIT released its financial results for the second half and full year ended 31 December 2025, demonstrating a strong operating performance, strategic acquisitions, and continued portfolio optimization…

January 18, 2026

Key Details of the Preferential Offering Offering Structure: The preferential offering was pro-rata and non-renounceable, with eligible unitholders entitled to 23 new units for every 100 existing units held as at 5:00 p.m. on 22 December 2025. Issue Price: Each…

January 2, 2026

Keppel REIT Dialogue: Detailed Report on Acquisition of One-Third Interest in Marina Bay Financial Centre Tower 3 Keppel REIT’s Strategic Acquisition of Additional Interest in MBFC Tower 3: Key Takeaways for Investors Introduction Keppel REIT Management Limited recently conducted a…

December 31, 2025

Keppel REIT Completes Acquisition of Additional Interest in MBFC Tower 3 Keppel REIT Completes Acquisition of Additional One-Third Interest in Marina Bay Financial Centre Tower 3 Key Highlights for Investors Acquisition Completion: Keppel REIT has successfully completed the acquisition of…

December 19, 2025

Keppel REIT Completes Major Acquisition of Top Ryde City Shopping Centre Keppel REIT Successfully Completes Acquisition of 75% Stake in Top Ryde City Shopping Centre, Sydney Key Highlights for Investors Acquisition Completion: Keppel REIT has finalized the acquisition of a…