📊 Statistics

- Analyst 1 Year Price Target:

$3.27

- Upside/Downside from Analyst Target:

14.66%

- Broker Call:

25

- Dividend Minimum 3 Year Yield:

5.43%

- EPS Growth Range (1Y):

200-500%

- Net Income Growth Range (1Y):

200-500%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

2026-02-05

💰 Dividend History

Current year to date yield:

5.76%

📅 SGX Earnings Announcements for A17U

CapitaLand Ascendas REIT (A17U)

Market: SGX |

Currency: SGD

Address: 168 Robinson Road

CapitaLand Ascendas REIT Singapore's first and largest listed business space and industrial real estate investment trust. It was listed on the Singapore Exchange Securities Trading Limited in November 2002. CapitaLand Ascendas REIT has since grown to be a global REIT anchored in Singapore, with a strong focus on tech and logistics properties in developed markets. As at 30 September 2025, its investment properties under management stood at S$17.7 billion. It owns a total of 231 properties across three segments, namely Business Space & Life Sciences, Industrial & Data Centres and Logistics. These properties are in the developed markets of Singapore, the United States, Australia, and the United Kingdom/Europe. These properties house a tenant base of approximately 1,790 international and local companies from a wide range of industries and activities, including data centres, information technology, engineering, logistics & supply chain management, biomedical sciences, financial services (backroom office support), electronics, government and other manufacturing and services industries. Major tenants include Sea Group, DSO National Laboratories, Stripe, Entserve UK, Singapore Telecommunications, DBS Bank, Seagate Singapore, DHL and Citibank. CLAR is listed on several indices. These include the FTSE Straits Times Index, the Morgan Stanley Capital International, Inc, the European Public Real Estate Association/National Association of Real Estate Investment Trusts Global Real Estate Index, the Global Property Research Asia 250 and FTSE4Good Developed Index. CapitaLand Ascendas REIT has an issuer rating of ?A3' by Moody's Investors Service. CapitaLand Ascendas REIT is managed by CapitaLand Ascendas REIT Management Limited, a wholly owned subsidiary of CapitaLand Investment Limited, a leading global real asset manager with a strong Asia foothold.

Show more

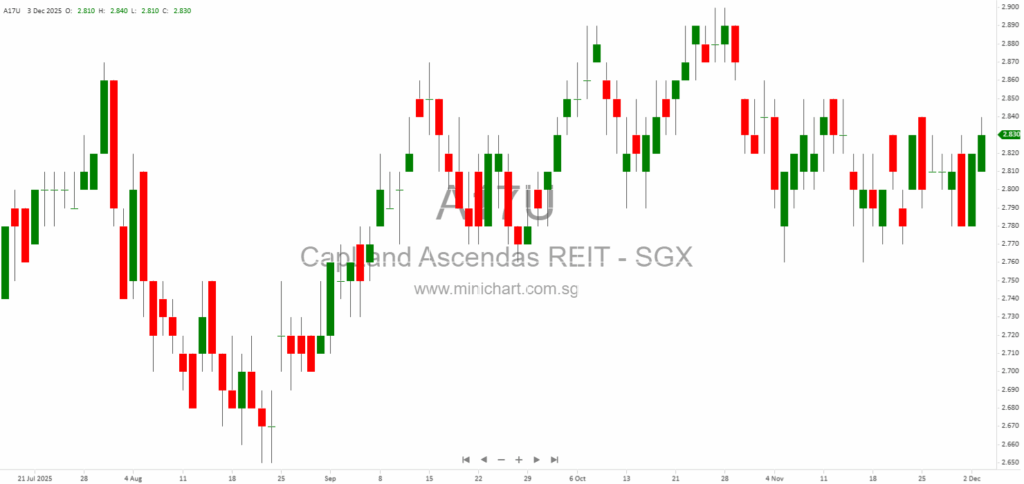

📈 CapitaLand Ascendas REIT Historical Chart

🧾 Recent Financial Statement Analysis

January 29, 2026

CapitaLand Ascendas REIT Completes Acquisition of DHL Canal Winchester Property in the US CapitaLand Ascendas REIT Completes Acquisition of DHL Canal Winchester Property in the US CapitaLand Ascendas REIT (CLAR) has announced the successful completion of its acquisition of the…

January 23, 2026

CapitaLand Ascendas REIT Announces Changes to Board and Committees CapitaLand Ascendas REIT Announces Board and Committee Changes Key Points Investors Should Note Resignation of Ms Ong Lee Keang Maureen: Ms Ong has resigned as Non-Executive Independent Director and as a…

January 16, 2026

CapitaLand Ascendas REIT Acquires DHL Canal Winchester Logistics Property CapitaLand Ascendas REIT Announces Strategic Acquisition of DHL Canal Winchester Logistics Property for S\$94.5 Million Key Investment in the U.S. Midwest Logistics Market CapitaLand Ascendas REIT (CLAR) has unveiled the acquisition…

January 15, 2026

CapitaLand Ascendas REIT Announces Update to Board and Committees CapitaLand Ascendas REIT Announces Significant Update to Board and Committee Composition Key Highlights Appointment of New Director: Mr Tham Wei Hsing, Paul has been appointed as a Non-Executive Non-Independent Director and…

January 6, 2026

CapitaLand Ascendas REIT 3Q 2025 Business Update: Key Highlights for Investors CapitaLand Ascendas REIT Reports 3Q 2025 Business Update: Portfolio Expansion, Capital Management, and Sustainability Drive Overview CapitaLand Ascendas REIT (“CLAR”) has released its 3Q 2025 business update, revealing significant…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: A17U, CapitaLand Ascendas REIT

January 29, 2026

CapitaLand Ascendas REIT Completes Acquisition of DHL Canal Winchester Property in the US CapitaLand Ascendas REIT Completes Acquisition of DHL Canal Winchester Property in the US CapitaLand Ascendas REIT (CLAR) has announced the successful completion of its acquisition of the…

January 23, 2026

CapitaLand Ascendas REIT Announces Changes to Board and Committees CapitaLand Ascendas REIT Announces Board and Committee Changes Key Points Investors Should Note Resignation of Ms Ong Lee Keang Maureen: Ms Ong has resigned as Non-Executive Independent Director and as a…

January 16, 2026

CapitaLand Ascendas REIT Acquires DHL Canal Winchester Logistics Property CapitaLand Ascendas REIT Announces Strategic Acquisition of DHL Canal Winchester Logistics Property for S\$94.5 Million Key Investment in the U.S. Midwest Logistics Market CapitaLand Ascendas REIT (CLAR) has unveiled the acquisition…

January 15, 2026

CapitaLand Ascendas REIT Announces Update to Board and Committees CapitaLand Ascendas REIT Announces Significant Update to Board and Committee Composition Key Highlights Appointment of New Director: Mr Tham Wei Hsing, Paul has been appointed as a Non-Executive Non-Independent Director and…

January 6, 2026

CapitaLand Ascendas REIT 3Q 2025 Business Update: Key Highlights for Investors CapitaLand Ascendas REIT Reports 3Q 2025 Business Update: Portfolio Expansion, Capital Management, and Sustainability Drive Overview CapitaLand Ascendas REIT (“CLAR”) has released its 3Q 2025 business update, revealing significant…

December 31, 2025

Broker Name: Lim & Tan Securities Date of Report: 30 December 2025 Excerpt from Lim & Tan Securities report. Singapore’s FSSTI Index posted strong year-to-date gains (+22.3%), outperforming many global peers, with the major US indices (S&P, Nasdaq, Dow) also…

December 30, 2025

CapitaLand Ascendas REIT: Major Portfolio Acquisition in Singapore and Strategic US Divestment CapitaLand Ascendas REIT Completes S\$565.8 Million Singapore Acquisition and Premium US Divestment Key Highlights Completion of S\$565.8 Million Acquisition: CapitaLand Ascendas REIT (“CLAR”) has finalized the purchase of…

December 17, 2025

CapitaLand Ascendas REIT Completes Divestment of Four Singapore Properties CapitaLand Ascendas REIT Completes S\$329 Million Divestment of Four Singapore Properties Key Highlights Completion of Divestment: CapitaLand Ascendas REIT (CLAR) has completed the divestment of a portfolio consisting of four properties…

December 10, 2025

Key Points from the Announcement Divestment Completed: CapitaLand Ascendas REIT (CLAR) has finalized the sale of its logistics property at 95 Gilmore Road, located in Queensland, Australia. Premium to Valuation: The property was divested at a price higher than its…

December 3, 2025

CapitaLand Ascendas REIT Announces Board and Committee Changes Effective December 2025 CapitaLand Ascendas REIT Announces Changes to Board and Committee Composition Key Highlights Retirement of Non-Executive Non-Independent Director: Mr Vinamra Srivastava will retire as Non-Executive Non-Independent Director and Member of…