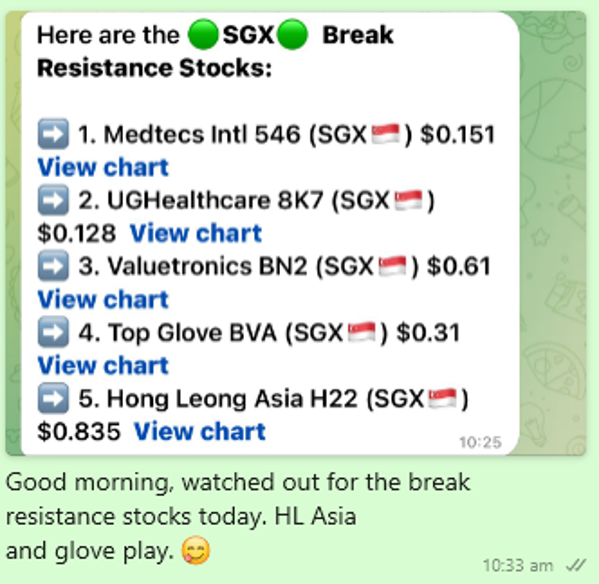

Yesterday, Hong Leong Asia and several glove manufacturing stocks broke through key resistance levels, signaling a potential upward trend. From a technical analysis perspective, these stocks now show potential for a further 4% to 6% increase in value. This breakout suggests renewed investor interest and momentum in these sectors, possibly driven by market optimism and improving fundamentals. Investors may view this as an opportunity for short-term gains as these stocks approach their next resistance levels.

Investors are encouraged to follow “Minichart Auto Signal” for real-time updates and insights on the top-performing stocks of the day, identifying potential movers and shakers in the market. This tool can be key in spotting emerging trends and making timely investment decisions.

Thank you